AI is already part of our daily workflows. We expect it to draft emails, reconcile balances, and catch errors. Investment is only growing: McKinsey’s 2025 Superagency in the Workplace report shows that 92% of companies plan to increase AI spending over the next three years.

In accounting, accuracy isn’t just a nice-to-have. A single error can cascade into compliance failures, penalties, and reputational damage. That’s why “professional skepticism” has always been a pillar of the profession. Trusting AI feels risky, unless it’s provably reliable.

The solution is vertical AI: purpose-built for accounting and designed with accuracy and explainability. In this post, we’ll explore how we define and measure accuracy, why vertical AI outperforms general-purpose AI in accounting, and look at a concrete example of mathematical consistency.

Best accounting tools to ensure AI accuracy

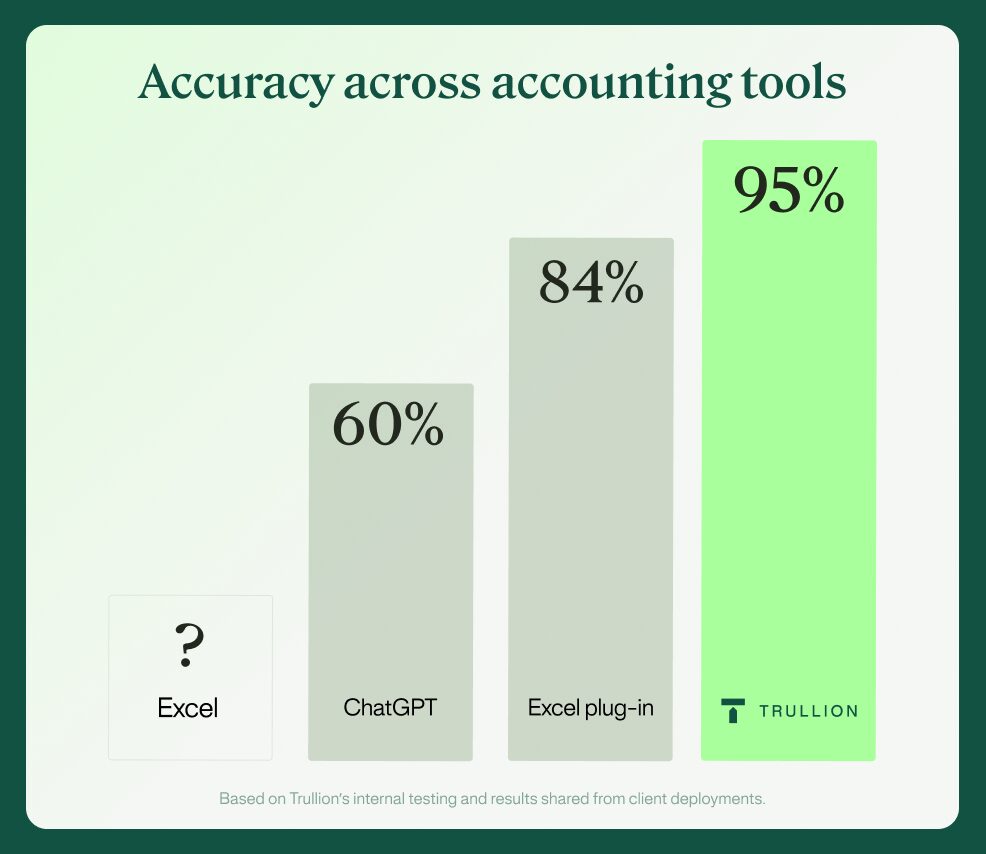

Accuracy is measurable. In internal testing and client feedback, Trullion’s AI consistently outperforms both general-purpose LLMs and Excel-based plugins.

A benchmark analysis across financial statements of varying size and complexity found that Trullion’s Financial Statement Validation module identified 95% of presentation errors – issues commonly missed through manual review and alternative automation tools.

These numbers translate directly into real-world impact. One client recently shared that Trullion flagged 1,110 findings and 34 discrepancies, while a leading Excel plug-in surfaced 984 findings and 0 discrepancies on the same dataset.

Capturing more true discrepancies means fewer blind spots, stronger documentation, and higher-quality work.

Real-world example: Trullion’s mathematical accuracy

One of the most direct ways to test AI accuracy in accounting is through mathematical validation: verifying that reported sums, subtotals, and totals in financial statements actually add up.

To test this, we analyzed over 120 pages of a Fortune 100 company’s annual report, verifying every table’s horizontal (line-level) and vertical (column-level) totals.

Trullion didn’t just work faster. While ChatGPT detected a limited set of straightforward totals, Trullion uncovered nearly 9x more summations and identified 190 inaccuracies, each tied to its exact source for instant review.

Unlike ChatGPT, which performs basic arithmetic without context or evidence linking, Trullion also delivers full traceability. Every discrepancy flagged connects back to the source document’s page, table, and value. Auditors don’t just see what’s wrong. They also immediately see why.

To see how Trullion’s accuracy and traceability apply to your team’s workflows, book a demo.

What accuracy means in AI for accounting

Accuracy isn’t one metric. It spans multiple steps, each building on the last, from capturing raw data to producing explainable outputs. Here’s how we measure it:

1. Coverage and speed

If AI only looks at a small subset of transactions, errors can hide in the blind spots. True accuracy means looking across the entire population of data, not just samples.

Speed also matters: a system that delivers high coverage but takes hours to process each workbook adds review overhead and erodes trust. The ideal is broad coverage, processed quickly, with minimal reviewer lift.

KPI examples: % population tested, cycle time per workbook, review minutes per exception

2. Extraction accuracy

The foundation is pulling the right numbers, dates, and terms from source documents. If extraction is off, everything downstream is unreliable.

KPI examples: % fields matching source, doc confidence threshold

3. Consistency

In documents, values appear in many forms: “one million,” “$1,000,000,” or “1.0M.” AI should recognize the same value across formats and flag contradictions when figures differ.

KPI examples: % repeated values captured consistently, % discrepancies flagged

4. Mathematical accuracy

Totals, cross-footings, and roll-forwards should reconcile automatically. Formula errors and manual slips are common in spreadsheets, and AI should catch them.

KPI examples: cross-foot pass rate, variance tolerance bands

5. Classification accuracy

AI should assign transactions, balances, and terms to the correct accounting treatments: ROU asset vs. lease liability, deferred revenue vs. earned revenue, operating expense vs. capital expense.

KPI examples: % correct account mapping, reviewer first-pass acceptance rate

6. Compliance accuracy

Outputs should align with ASC, IFRS, or whichever standard applies. This includes citing relevant guidance, applying the right recognition and measurement rules, and flagging exceptions.

KPI examples: % outputs with standard cites, exception repeat rate.

7. Explainability

The final layer: every conclusion should trace back to its source. Explainability links each output to its evidence, so reviewers can instantly validate accuracy.

KPI examples: % conclusions with links, time-to-evidence.

Why accuracy is hard to measure (and how leading firms get it right)

AI can give different answers to the same question depending on how it’s prompted. That variability makes “accuracy” look inconsistent – when in reality, it’s the inputs that are inconsistent.

To better evaluate accuracy, here are some best practices:

- Standardize prompts with templates: Define inputs and instructions consistently.

- Use prefilled phrasing: For recurring disclosures or reports, prebuilt language avoids variation.

- Set the role and rules upfront: Always tell AI what it’s working as (e.g., auditor, controller), with citations and risk flags required.

- Track version prompts in workpapers: Reviewers compare like-for-like, not apples-to-oranges.

When prompts are standardized, accuracy becomes measurable, governable, and improvable.

Debunking myths about accuracy

Myth: 95% isn’t good enough. When people hear “95% accuracy,” they ask: what about the other 5%? But it’s worth remembering that manual work isn’t perfect either.

A Gartner survey found that 18% of accountants make financial errors at least daily, and 59% at least monthly. Companies that adopt new technologies, on the other hand, see a 75% reduction in financial errors. Trullion delivers 95%+ accuracy even before human review, with every field linked back to its source for instant validation.

Myth: Accuracy is static. In reality, AI accuracy adapts. Trullion builds fast feedback loops into our platform, so model accuracy continuously improves via reviewer acceptance targets, exception taxonomies, and template refinements.

Why vertical AI beats general-purpose AI

Generic AI models are designed to handle mostly anything: summarize an article, write a poem, answer trivia. But in accounting, firms need accuracy, governance, and traceability built for the domain. That’s where vertical AI wins.

1. Data boundary

AI works in a closed loop on your uploaded contracts, spreadsheets, and disclosures. It never drifts into the open web. This ensures outputs are anchored to your evidence, not to probabilistic guesses that can encourage model hallucinations.

2. Domain-specific intelligence

General-purpose AI knows a little about a lot. Trullion knows a lot about one thing: accounting. It’s trained on standards like ASC and IFRS, and infused with domain-specific logic like roll-forward rules, lease classifications, and disclosure structures. This specialization raises accuracy.

3. Built-in traceability

Every output links directly back to its source. Even if the wording, numerical expression, or format changes, Trullion’s smart matching shows exactly where each figure originated. Reviewers can instantly see where the data came from and verify it in seconds.

Accuracy risks and how to mitigate them

Even the best AI comes with risks. What matters is how those risks are managed. Trullion layers safeguards at every step:

- Hallucinations: When AI isn’t confident, it doesn’t just make something up. Trullion uses confidence thresholds, flagging low-certainty fields for human review instead of guessing.

- Poor scans: Many financial documents arrive as low-quality scans with skewed text or faded numbers. Our technology applies OCR pre-processing to clean and normalize inputs, then runs layered accuracy checks to validate extracted data.

- Audit rejection: Auditors can’t accept AI outputs without a clear trail of evidence. Every workflow includes logs, version control, and citation coverage. Reviewers can see exactly what was done, by whom, and supported by which page or paragraph.

- Over-reliance: AI is powerful, but it can’t replace professional skepticism. We enforce a hybrid workflow: AI focuses on repetitive tasks like extraction and math checks, while humans handle judgment calls, risk assessments, and final sign-off.

Take the next step toward higher AI accuracy

Accuracy in accounting AI isn’t a single percentage point. It’s a portfolio of controls including coverage, extraction, consistency, math, classification, compliance, and explainability – all governed by structured prompts and feedback loops.

Building on those principles, Trullion achieves 95%+ accuracy and outperforms both generic LLMs and Excel plug-ins. When firms standardize their approach and pair AI with human oversight, they don’t just improve accuracy. They also accelerate throughput, reduce errors, and build defensible trust in their work.

Want to see vertical AI accuracy in action? Book a demo.