AI is no longer a “nice to have” for accounting firms – it’s an operational necessity.

Top firms already use AI for financial statement review, contract analysis, memo generation, policy research, and as an everyday accounting assistant. But most firms are still struggling to adopt and scale. That’s because they treat AI like traditional software-as-a-service (SaaS).

AI isn’t the next SaaS trend. It’s the operating system for the next generation of firms. Where SaaS streamlined tasks, AI redefines how firms think, decide, and grow.

AI changes everything:

- People. A senior associate may master prompts overnight, while a partner hesitates to trust them. Without role-based enablement, adoption stalls.

- Processes. Generic AI tools collapse under the weight of accounting’s rules and rigor. Audit workflows require precision, not approximations.

- Data. No AI is smarter than its inputs. Without structured ingestion of trial balances, contracts, and memos, outputs are unreliable.

That’s why firms don’t need another vendor selling them a plug-in or point solution. Tools alone won’t move the needle – they only add to the pile of disconnected software firms are already juggling.

Firms need a partner – someone who understands the complexity of accounting workflows and can help translate AI into lasting change. Because the truth is, adoption isn’t as simple as flipping a switch.

Barriers to AI adoption in accounting firms

According to Grant Thornton’s 2025 Digital Transformation Survey, only 27% of business leaders believe their technology fully supports their firm’s goals. Rolling out AI isn’t about toggling a feature or flipping a switch. It’s a transformation across three key areas:

1. People: AI skills vary widely

With traditional SaaS, most people pick up the tool at about the same pace, and usage levels out quickly. AI is different. Some get immediate value and speed ahead, while others struggle to keep up. That gap between power users and hesitant users slows firm-wide adoption.

What works. Role-based training. Trullion tailors prompt libraries and resources by role (audit staff, QC reviewers) and vertical (NFP, commercial, EBP), meeting people at their needs and skill levels.

2. Process: AI needs to fit real workflows

Generic AI tools break down in structured, rules-based environments because they’re built for broad, flexible use cases—not for domains where every number must tie out and every step follows strict standards. In accounting and audit, workflows demand precision. Controls, reporting rules, and compliance requirements aren’t optional.

Example. Trullion’s Financial Statement Review instantly flags missed footnotes, disclosure inconsistencies, and formatting errors. These aren’t ad hoc queries – they’re specific, embedded workflows.

What works. Firms need software that embeds into the critical workflows, not only around them.

3. Data: You can’t get good AI outputs without good AI inputs

Even the best LLMs are only as smart as the data they’re fed. Many vendors skip this step entirely – leaving firms wondering why results are generic and unreliable.

What works. Every Trullion rollout starts with a Data Blueprinting Workshop. We collect both firm-wide materials (methodology guides, policy memos) and engagement-specific inputs (contracts, trial balances, GLs). Outputs are accurate, contextual, and ready for review from day one.

Pricing that reflects the value of the work, not just the number of users

Most vendors price per seat. But AI usage doesn’t follow seat-based patterns. One team might heavily use Trulli prompts, while another focuses on automated matching. Seat-based pricing often means overpaying before you see value.

What works. Trullion prices by engagement volume, not headcount. We provide unlimited seats, predictable costs, and pricing tied to audit throughput.

Many AI initiatives fail not because the technology doesn’t work – but because the pricing model breaks under pressure, the vendor disappears after onboarding, or firms can’t grow internal AI adoption.

AI adoption is iterative, and firms need a learning partner

AI is evolving exponentially. Use cases that seemed impossible six months ago are routinely solved by the newest state-of-the-art foundation models, like GPT-5.

The most successful firms we see treat adoption as a living, iterative process – instead of a one-time rollout:

- Start with anchor use cases. Launch with 1–2 high-impact, tightly scoped workflows – like Financial Statement Review or Revenue Testing. Results can be measured quickly (often within 1–2 weeks), and the learning curve is manageable.

- Iterate with insight. Trullion provides firm-wide reporting and dashboards, tracking usage by staff, engagement, and use case. Teams can surface underperforming areas – say, an office lagging in FS Review usage – and direct tailored enablement there. Our Customer Success team reviews these patterns weekly with clients.

- Scale only after proof. Once teams nail 2–3 repeatable use cases, we help templatize them and build prompt packs for cross-engagement rollout – supported by “train the trainer” programs.

Top 100 firms work with Trullion across a continuous deployment model – refining workflows, uploading new data sets, and even helping shape the product roadmap. That’s what being an AI partner looks like.

Why leading accounting firms choose Trullion

Our Audit and Advisory Suites serve 50+ firms across thousands of users and workflows: Test of Details, document extraction, financial statement analysis, and more. We’ve seen what works — and what doesn’t — in AI adoption for accounting.

Our approach is shaped by these principles:

- Explainable AI. Our tech is built with closed-loop architecture: firm-uploaded data, cited sources, and transparent outputs that show the work. You always stay in control.

- Use-case first. Our AI is guided by real workflows and outcomes. Our Customer Success and Product teams also serve as advisory partners, working side-by-sdie with clients to build, refine, and scale workflows.

- Vertical depth. Our platform is purpose-built for audit and accounting. It’s trusted for judgment-heavy, compliance-critical tasks – far beyond what generic vertical SaaS tools can handle.

- Continuous learning. Instead of static design, our AI improves through real-world use. Every prompt, output validation, and new file type feeds back into the system — ensuring the technology evolves with your needs and driving more accurate results.

Conclusion: AI deployment isn’t traditional SaaS implementation

AI adoption is messier, more iterative – and, when done right, far more impactful. The firms succeeding aren’t looking for another vendor. They’re looking for a proven partner who can build and grow with them.

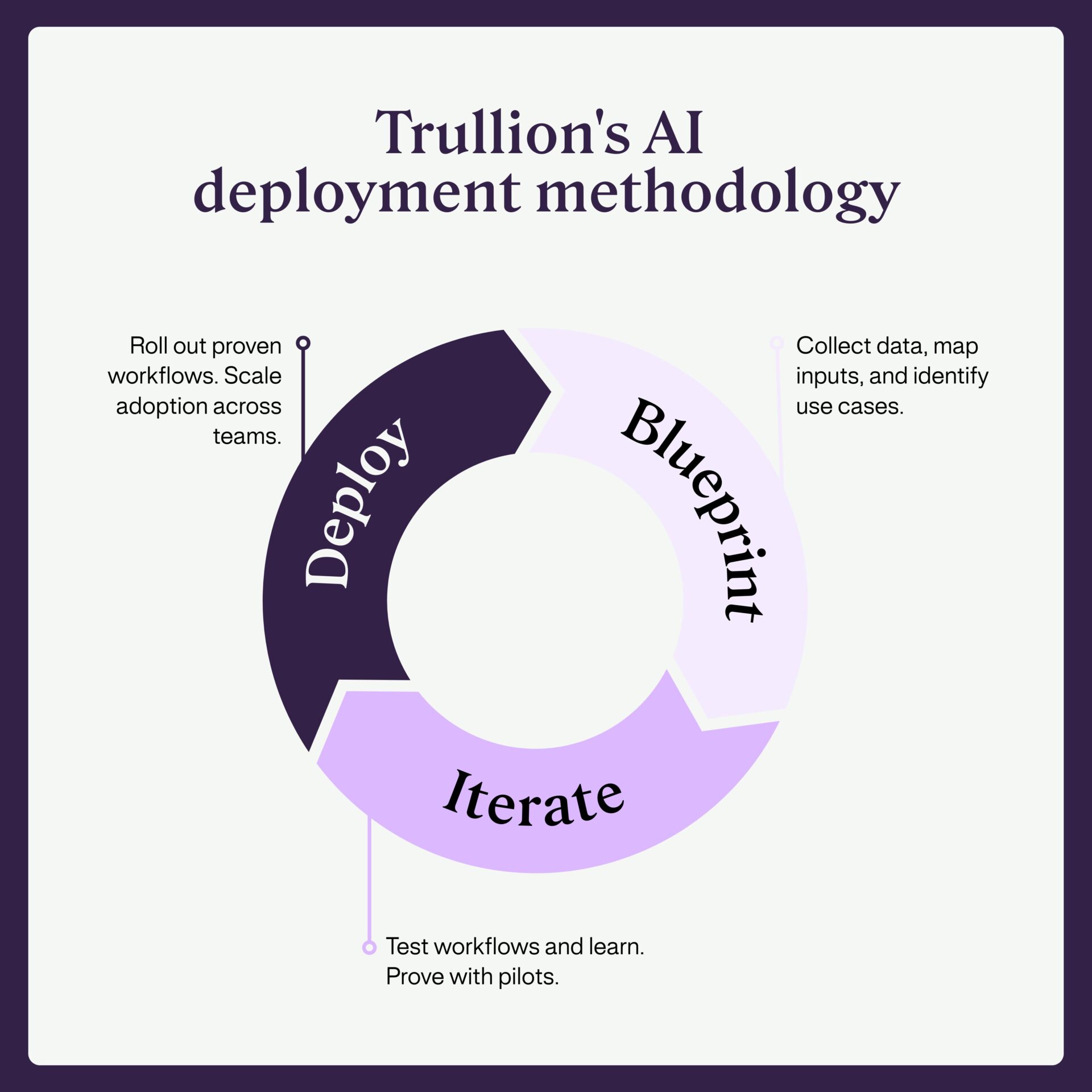

Next up in the series: In our next blog post, we’ll dive deep into Trullion’s AI Deployment Methodology – how we co-design, deploy, and continuously improve AI workflows with our clients, customized to their goals, team structures, and success metrics.