Internal audit teams are under pressure – more regulations, tighter timelines, higher expectations. The tools for day-to-day work haven’t evolved to keep up.

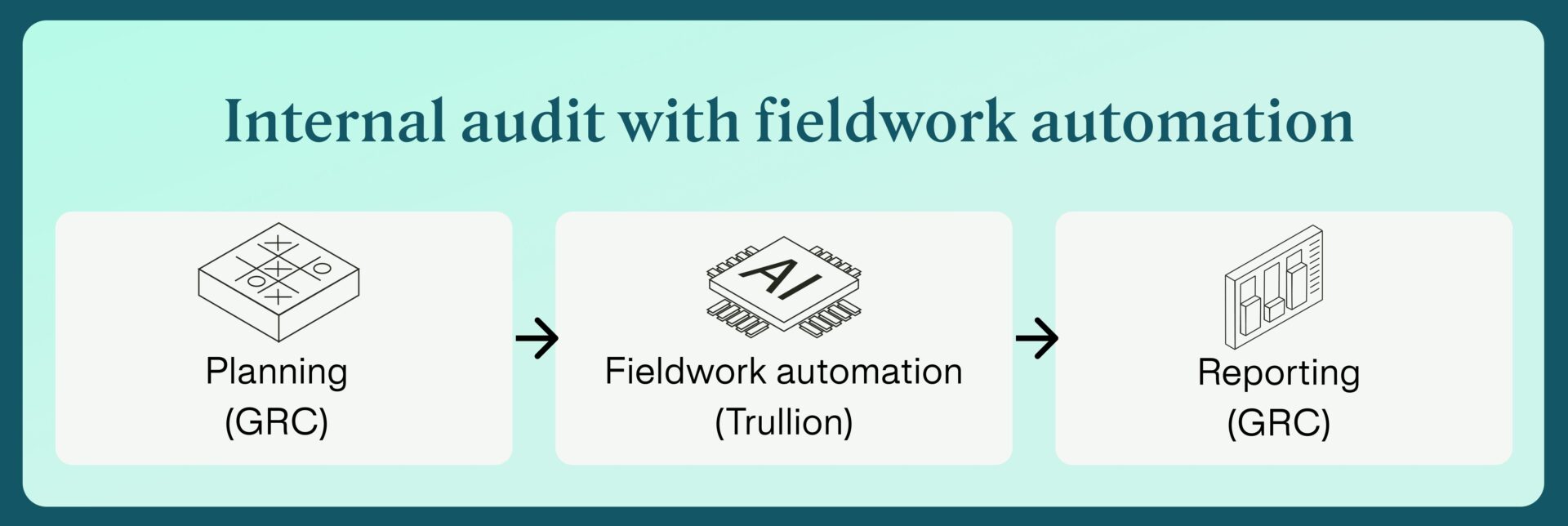

Most teams have a GRC platform in place. These systems help with planning, risk assessment, and reporting. But when it’s time to actually execute tests and reconcile evidence, auditors are left stitching together screenshots, spreadsheets, and PDFs.

Fieldwork automation is designed to fix this. It’s a dedicated layer between your GRC and your data, and helps you execute testing quickly, accurately, and at scale.

Why fieldwork is still the bottleneck

Based on dozens of our conversations with internal audit teams and partners, 60-80% of audit work is fieldwork – collecting evidence, reviewing documents, and performing control tests. Most of it is still done by hand.

And it’s systemic. According to the Internal Audit Foundation’s 2025 Pulse of Internal Audit report:

- 47% of Chief Audit Executives (CAEs) report insufficient funding for their departments

- Only 41% of internal audit teams are using AI in any form

- Of those, just 6% use AI for fieldwork

In practice, this inefficiency looks like:

- Testing lease payments by copy-pasting terms from scanned contracts

- Manually validating AP invoices against POs and GRNs

- Sampling policy compliance by reading PDFs, line by line

GRCs help structure the top and bottom of the audit workflow. But the middle – the actual testing work – remains fragmented and slow. This is where fieldwork automation comes in – not to replace your process, but to finally support it at scale.

What fieldwork automation actually does

Fieldwork automation uses AI to extract, compare, and reconcile information from documents to support control testing. This includes:

- Pulling key terms from leases, POs, HR documents, and ledgers

- Matching structured ERP data to unstructured documents

- Summarizing policies and control narratives

- Applying reusable templates for common control tests

Importantly, fieldwork automation doesn’t replace audit judgment. It replaces the repetitive part of the work — extracting and comparing the same types of data across hundreds of files.

It also doesn’t replace your GRC. Platforms like AuditBoard and Workiva are essential for managing risk, documenting controls, and organizing the audit lifecycle. But they weren’t built to execute testing. Audit teams still have to extract documents, perform tests, and validate results manually — outside those systems.

That’s where Trullion fits in. It’s not a plug-in or a bolt-on. It’s a cloud-based platform, designed specifically for fieldwork automation.

Trullion automates the heavy lifting — from evidence extraction to reconciliation — and feeds results directly back into your GRC, closing the loop between planning and reporting.

Why you need Trullion, not more spreadsheets

A lot of internal audit fieldwork still runs through Excel. It’s familiar, flexible, and easy to pick up. But it was never designed to handle what today’s audits require:

- Large-scale reconciliations

- Unstructured source documents

- Cross-functional collaboration

- Complete, reviewable audit trails

Plug-ins can help around the edges — autofilling here, scraping there — but they don’t solve the core issue. The more complex the audit, the more Excel begins to break down: version control issues, fragmented evidence storage, and lagging spreadsheets.

Trullion was built to address this. It:

- Extracts and matches data directly from documents

- Centralizes evidence and control testing in one place

- Maintains a full audit trail

- Supports role-based access for teams, reviewers, and clients

It doesn’t try to turn Excel into something it’s not. It replaces the parts of it that slow you down and expose your teams to unnecessary risk.

The value of fieldwork automation

- Time. Streamline audit procedures with AI-driven data extraction, matching, and validation – saving hours on each engagement.

- Coverage. Move beyond sampling with full-population testing that doesn’t require scaling headcount. Just upload the docs, and AI does the rest.

- Accuracy. AI reconciles data, flags mismatches, and checks for mathematical accuracy. Reduce manual errors and get reliable, traceable results.

- Compliance. Built-in compliance rules engine and financial logic models accelerate SOX, GDPR, and internal policy reviews.

Use cases for fieldwork automation

Fieldwork automation applies across industries and control types. Examples include:

- Real estate: Lease term ➝ AP tie-out

- Manufacturing: PO ➝ GRN ➝ Invoice matching

- SaaS: Revenue recognition against contract terms

- Financial services: KYC document validation

- Pharma: Vendor master review against AP ledgers

- Retail: POS discount compliance

- Healthcare: Patient billing vs. insurance reconciliation

What’s next

In the coming weeks, we’ll publish a full fieldwork automation guide. It’s designed to help internal audit teams start small, prove out automation, and scale across engagements without changing their core GRC setup.

Fieldwork is still where audits slow down. But now, it’s also where teams have the clearest opportunity to move faster – with confidence.