Stepping back and evaluating

When the changes in lease accounting were first announced – particularly ASC 842 and IFRS 16 – there was much ambiguity and apprehension in terms of the best way for a company to manage its leases.

Now that the dust has settled, a few things have become clearer. First, a lease accounting software solution is critical when it comes to managing leases and complying with new regulations. And second, not all lease accounting software is created equal.

Now is therefore the perfect time to reevaluate your current accounting software, and make sure you’re getting a best-of-breed solution that makes your life exponentially easier.

Risks of outdated lease accounting software

There are several risks associated with using a lease accounting software solution that is not among the market leaders.

Key questions to ask include:

- Is my current solution cloud-based and kept constantly updated by the provider?

- Does my solution automate my tedious manual tasks, freeing me up for high-impact projects?

- Can my solution handle the entire process from scanning a lease to journal entries, and right up to disclosure requirements?

- Does my solution do the accurate accounting that’s not extremely time-consuming for my company’s unique operational deployment of my leases?

If you answered “No” to any of these questions, you should strongly consider replacing your existing lease accounting software provider.

Signs that it’s time for a replacement

What are some of the other signs that point to needing a replacement? For example, if your software solution hasn’t significantly reduced the amount of time you spend on leases, that’s a major red flag.

In a 2023 industry survey of finance professionals across a range of industries, 50% of respondents said saving time by reducing manual work is the most important role of financial technology tools.

Other issues to look out for include having to go through manual updates of the system, UI/UX frustrations, a lack of support, a clunky user experience, or other similar signs that your software may not be keeping up with your needs.

Choosing a new lease accounting software solution

With the opportunity to replace your existing software, it’s important to consider what to look for in new lease accounting software. While each company is different, with different needs, generally there are some common elements to look out for. Many of these are closely related to the questions we asked previously.

So, when choosing a new provider, check that the following are present:

- Seamless automation: that takes care of manual processes and saves you time

- Security: ensure that certifications such as SOC 2 are in place

- Support: is the company there to help you with the initial onboarding, and ongoing usage?

- Audit trail: ensure every step of the process can be tracked by all stakeholders

- Modification detection: the best lease accounting software solutions detect and account for changes in real-time

- Quick and easy setup: your provider should be able to guarantee that you’ll be fully up and running within a matter of days, not months

The challenging part of lease accounting software adoption is now behind us

Although the prospect of replacing software may bring back frustrating memories from the initial compliance project and software implementation, replacing lease accounting software is more straightforward than you might imagine.

When companies initially adopted the new lease accounting standards, two of the biggest challenges they faced were:

- Gathering all leases and abstracting the right information into a database

- Defining policies and procedures for ongoing operations under the new guidance

However, when replacing lease accounting software, companies can migrate existing data to a more effective platform and apply previously defined policies, procedures, and discount rates in a system that simplifies the management of these profiles and tables. The benefits of this approach are that it eliminates the need to revisit the up-front data challenges.

Making the switch

Once you’ve decided to make the switch, and migrate to a better solution, you want to ensure that the transition is a smooth one. The good news is that the industry leaders make it super easy to switch over to their solutions. At Trullion, for example, we’ll be happy to walk you through the process to ensure you have all your bases covered.

Data Integrity

When moving data into a lease accounting tool from an existing system, the first issue to address is data integrity. It’s essential to ensure that the data is valid and accurate and has been regularly updated. An important question to ask when evaluating the state of the data is whether you would be comfortable using it for an audit.

Once you’re confident that your data is in good shape, the rest of the migration process is typically straightforward.

System configuration

Prior to migrating your data, configure the new solution to align with your long-term needs. Take advantage of this opportunity to enhance your system setup based on your updated understanding of your needs.

Lease review and data migration

During the migration process, your new solution provider should guide you through the review of your lease data in the platform, including verifying the accuracy of the entered data and confirming that the reporting outputs meet your organization’s lease accounting standards.

Testing and Validation

A critical step in implementing any solution is testing and validation. It’s essential to partner with a provider who has a documented process and a proven track record for covering this crucial step in the implementation process.

Journal Entries and Disclosure

Ensure your company is well-prepared to meet compliance deadlines by conducting a trial run of your lease accounting journal entry and disclosure process before the due date.

Run accounting reports in both systems

After the go-live date, cross-check the outputs of accounting reports in both old and new systems to verify that all numbers are accurate. This will help you identify discrepancies or errors that need to be resolved.

Accounting software: now’s the time to level-up

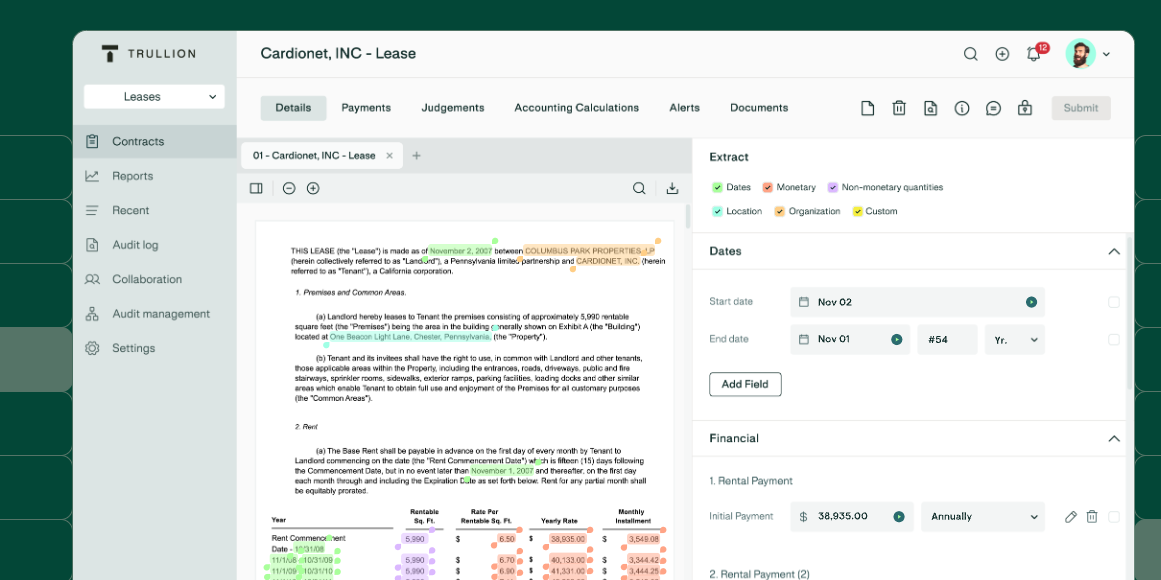

Trullion’s platform is designed to simplify lease accounting compliance with the latest FASB and IFRS lease accounting standards, ensuring accuracy and minimizing the risk of errors. Our unique feature set, including advanced reporting capabilities and AI-powered data extraction, provides a user-friendly, comprehensive solution that meets the specific needs of companies and their accounting teams.

Migrating from your current software provider to Trullion is simple – we’ll take care of the heavy lifting for you. To speak to a migration expert, get in touch with Trullion today.