AI is no longer a nice-to-have. It’s become the backbone for modern finance teams to stay compliant, efficient, and competitive.

For decades, financial operations have run on spreadsheets and manual reconciliations. Today, AI is rewriting the playbook — turning static processes into smart systems that think, adapt, and scale with your business.

Why AI is reshaping finance and accounting

Finance and accounting teams today face more pressure than ever before:

- Talent shortages, with a mass exodus from accounting, leave fewer staff to manage growing workloads.

- Manual processes continue to be a leading cause of costly errors, misstatements, and audit delays.

- Regulatory requirements are becoming increasingly complex due to ESG disclosures, updated lease (ASC 842) and revenue (ASC 606) standards, and evolving global tax requirements that demand integrated data, deeper documentation, and stronger controls.

At the same time, AI is raising expectations. Lean teams are now expected to operate with the speed and scale of large enterprises.

AI financial software addresses some of these challenges by automating routine tasks and enhancing accuracy and visibility, freeing teams to focus more on analysis and strategy.

This isn’t just about incremental gains in efficiency. It represents a transformation in how finance teams operate, on par with our society’s rapid integration with new technologies and capabilities.

Here’s how AI is fundamentally changing finance work:

- Proactive risk prevention. Modern AI tools detect anomalies — from unusual journal entries to risky contract clauses — before they escalate into audit issues. With agentic AI, these anomalies can be flagged before any human involvement.

- Smarter workflows. Automation helps teams move beyond manual, fragmented processes into building custom, more connected workflows. This eliminates repetitive tasks, creates smoother handoffs, and speeds up results.

- Proactive insights. Predictive analysis — powered by advanced AI — shifts reporting from retrospective data outputs to forward-looking insights. By providing recommendations and strategic guidance, teams can make faster, more informed decisions.

- Specialized AI agents. Will AI replace accountants? Not anytime soon, but today’s AI tools are more than just generic chatbots. They include specialized finance agents that can handle accounting tasks and continuously learn the specifics of your business functions.

With AI integrated across your workflows, ERP, procurement, CRM, and payment systems, your team gets a real-time, unified view of business health. Fragmented processes become clear, actionable insights.

Vertical AI and agentic AI: Specialized software delivers unprecedented impact

The AI landscape is shifting from broad, general-purpose tools to vertical AI solutions built specifically for industries like finance and accounting. These specialized AI agents are designed with deep domain knowledge and are flexible enough to integrate seamlessly with ERPs, compliance frameworks, and operational systems.

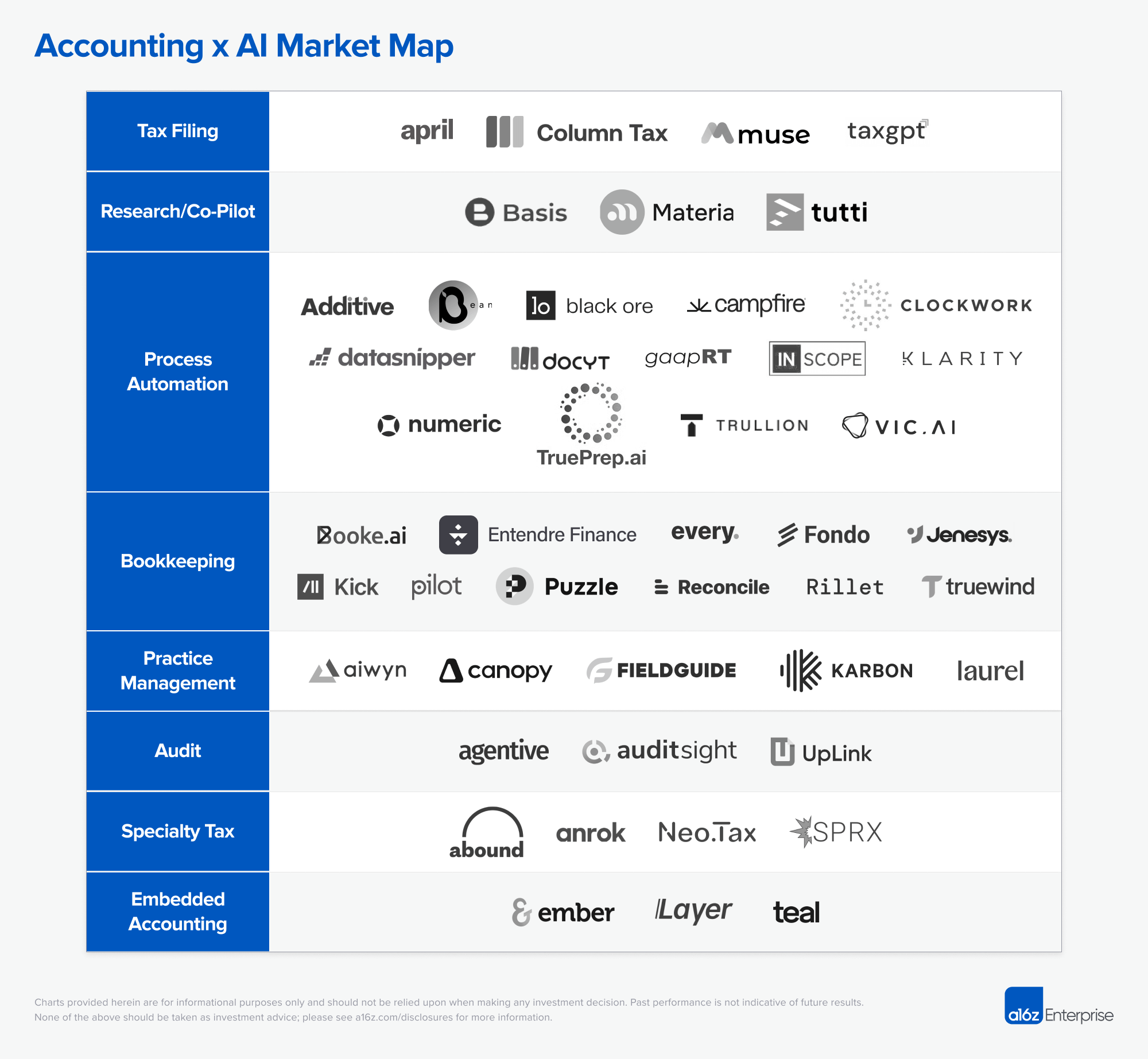

As the a16z market map highlights, venture investment is accelerating into vertical AI software that tackles accounting’s most complex use cases — from tax and audit to practice management, revenue recognition, and financial close.

Increasingly, these solutions also incorporate agentic AI. Beyond automation, agentic AI works autonomously and within context. It surfaces insights proactively, recommends next steps, and dynamically adapts workflows based on user intent and business priorities.

An example of this shift in action: Trullion’s AI-powered chatbot, Trulli, was built to deliver specialized insights for finance teams.

By combining vertical AI with agentic AI, a new generation of tools is emerging – helping finance teams move faster, work smarter, and operate with greater strategic clarity.

The five best AI software for finance and accounting

Here are the standout AI platforms transforming how teams work:

1. Aiwyn

Best for: Accounting firms seeking to optimize client engagement and cash flow.

Aiwyn is a revenue operations platform. It automates collections, invoicing, and payments to accelerate cash flow and improve overall client experience:

- Centralized dashboards provide real-time visibility into WIP, AR, and revenue trends

- Integrated practice management tools unify operations, enabling teams to manage billing, payments, and client communications in one place

2. Numeric

Best for: Controllers looking to automate and orchestrate the month-end close.

Numeric is an AI-first close management platform for reconciliations, controls, and compliance:

- Automates GL reconciliations by tagging transactions and surfacing anomalies instantly

- Tracks and manages tasks across the close checklist to ensure no steps are missed

- Facilitates collaborative reviews with built-in approval workflows – creating a structured, transparent close process

3. Karbon

Best for: Finance and accounting teams managing high volumes of client work.

Karbon consolidates communication, tasks, and workflows into a single platform tailored for accounting operations:

- AI-enhanced tools automate email management and client communication tracking

- Centralized task management allocates work efficiently across teams

- Custom workflow templates, auto-reminders, and integrated time tracking improve productivity and accountability

- Performance analytics provide visibility into team utilization, budgets, and client service delivery

4. Rillet

Best for: Multi-entity finance teams seeking a modern, AI-powered ERP.

Rillet reimagines ERP with AI as its foundation, enabling finance teams to close books faster with higher accuracy:

- Provides a real-time general ledger with zero-day close capabilities

- Automates bank reconciliations, AR/AP workflows, and cash forecasting using AI-driven models

- Supports multi-entity consolidations seamlessly, giving CFOs unified visibility across subsidiaries and markets

5. Trullion

Best for: Accounting, lease accounting, and audit teams looking for a scalable, flexible solution to automate compliance and reporting workflows.

Trullion combines advanced AI with deep accounting logic to deliver compliant, audit-ready outputs:

- AI-driven data extraction and reconciliation. Converts unstructured data from PDFs, spreadsheets, CRM, and billing systems into structured, validated accounting inputs using OCR and advanced AI.

- Configurable accounting logic. Applies embedded financial models to enforce compliance with ASC 842, ASC 606, IFRS, and internal policies.

- Comprehensive workflows. Automates lease accounting, revenue recognition, audit preparation, and financial statement generation in one platform.

- Agentic AI assistant. Trulli provides contextual, source-backed guidance on standards, documents, and accounting treatments.

- Full audit trail. Maintains transparent and traceable records that link every output back to its source data and logic.

Strategic implications: The shift from manual to done-for-you AI financial software

Accounting is changing fast. Instead of combing through hundreds of documents, accountants now start by reviewing AI-generated insights and recommendations.

Auditability remains non-negotiable. The best AI solutions maintain full traceability, linking outputs back to source data — a requirement for external audits and regulatory reviews.

Early adopters of AI-powered accounting platforms are already experiencing significant benefits: faster closes, improved compliance, stronger controls, and real-time visibility that traditional tools simply can’t match.

Conclusion: Choosing the right AI tools for finance and accounting

AI is rapidly redefining what’s possible in finance and accounting, but not every solution is built for the job.

The next generation of finance teams will be shaped by the tools they use. Solutions built for accounting, not just general automation, will lead the way.

At Trullion, we’ve designed our AI specifically for the complex needs of accounting and finance teams:

- Purpose-built AI for accounting logic and best practices

- Agentic AI flexibility that adapts to your business and uncovers insights proactively

- Full transparency and auditability with clear links back to your source data

- Trusted by leading teams for lease accounting and audit readiness

See how Trullion can save your team hundreds of hours — and free up time to drive strategic impact. Book a demo.