ASC 842 and IFRS 16 changed the way companies accounted for leases. Replacing previous standards ASC 840 and IAS 17, these new releases were introduced to standardize the way organizations dealt with leases, as well as close some of the gaps that were used in questionable accounting practices by the likes of Enron and WorldCom.

One of the most significant elements of ASC 842 and IFRS 16 is calculating the lease liability, together with the other calculations and entries that flow from this. We’ll go through the steps required in order to calculate the lease liability, and we’ll also take a look at some common pitfalls and helpful tips when it comes to this calculation.

How to calculate lease liability under ASC 842 and IFRS 16

ASC 842 and IFRS 16 set out the principles for the recognition, measurement, presentation, and disclosure of leases. The object of the standards, for example, as presented in IFRS 16, is to ensure that “lessees and lessors provide relevant information that faithfully represents those transactions.”

The standards mandate the recognition of a right-of-use asset and a lease liability. These two elements are fundamentally related to one another – indeed, one cannot calculate the value of the asset without first working out the value of the lease liability.

This is because the right-of-use asset is initially measured at the value of the lease liability, plus:

- Any initial direct costs incurred by the lessee

- Any adjustments required relating to lease incentives, payments prior to commencement of the lease, and similar situations

What’s clear is that the first and most important calculation is that of the lease liability.

Lease liability measurement

According to ASC 842 and IFRS 16, the lease liability value is calculated with the following formula:

- The present value of the lease payments payable over the lease term

- Discounted at the rate implicit in the lease

Now, if the “rate implicit in the lease” cannot be readily determined, the company’s incremental borrowing rate should be used. If the company is private, the risk-free rate can be used.

For example, should a lease agreement not have a readily available rate implicit within it – but a rate of interest for the company, at the commencement date of the lease, for a similar asset over a similar period, in a similar economic environment, would be 4% – that 4% can be used in calculating the present value of the lease payments.

The lease liability calculation should be done at the commencement date; that is the date upon which the asset in question is available for use by the lessee.

What constitutes lease payments exactly, that need to be discounted to present value? This includes:

- Fixed lease payments, minus any lease incentives

- Amounts expected to be paid by the lessee under residual value guarantees

- The exercise price of a purchase option, should that option be reasonably certain to be exercised

- Any payments relating to terminating the lease

Armed with the lease payments and the discount rate, you can now easily calculate the lease liability and by extension, the right-of-use asset.

Calculating lease liability example and steps

We’ll look at a high-level example to demonstrate the steps and processes.

Let’s assume that a company is entering into a 3-year lease for a new machine, with lease payments of $20,000 per year payable in advance, and a discount rate of 4%.

Calculations

First, we’ll calculate the present value of the lease payments at the beginning of each period. Using the information above, we calculate:

- The present value at the beginning of year 1: $57,721.89 (A)

- The present value at the beginning of year 2: $39,230.77 (B)

- The present value at the beginning of year 3: $20,000 (C)

To recap:

- The term is 3 years (D)

- Lease payments are $20,000 per year (E)

- The discount rate is 4% (F)

Steps

There are four key elements to calculate:

- The initial right of use asset and lease liability

- The winding down of the lease liability

- The interest expense

- The depreciation of the right-of-use asset

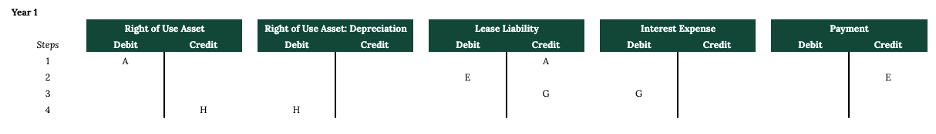

Year 1

- The initial right of use asset and lease liability: Debit the right of use asset with $57,721.89 (A), credit the lease liability with $57,721.89 (A)

- The winding down of the lease liability: Debit the lease liability with $20,000 (E), credit the payment method with $20,000 (E)

- The interest expense: Debit interest expense with $1,508.88 (G) (lease payment E, less the difference between present value Year 1 “A” and present value Year 2 “B”) and credit the lease liability with this amount

- The depreciation of the right of use asset: Debit the right of use asset depreciation account with $18,491.12 (H) (difference between interest expense and lease payment A), credit the right of use asset with this amount

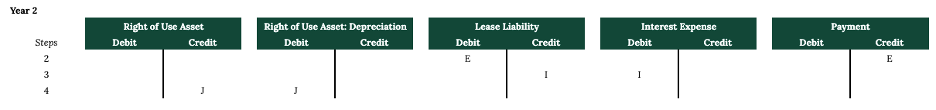

Year 2

- The winding down of the lease liability: Debit the lease liability with $20,000 (E), credit the payment method with $20,000 (E)

- The interest expense: Debit interest expense with $769.23 (I) (lease payment E, less the difference between present value Year 2 B and present value Year 3 C) and credit the lease liability with this amount

- The depreciation of the right of use asset: Debit the right of use asset depreciation account with $19,230.77 (J) (difference between interest expense and lease payment A), credit the right of use asset with this amount

Year 3

- The winding down of the lease liability: Debit the lease liability with $20,000 (E), credit the payment method with $20,000 (E)

- The depreciation of the right of use asset: Debit the right of use asset depreciation account with $20,000 (K) (difference between interest expense – in this case, zero – and lease payment A), credit the right of use asset with this amount

Should additional elements be introduced, these should be accounted for in line with the standards. For example, if there were a downpayment for the lease of $100, the initial entry would include debiting the right-of-use asset with $100 and crediting the payment method with this amount.

If there are monthly service payments, these would be debited in the relevant expense account, and credited to the payment method.

Challenges and tips

With ASC 842 and IFRS 16 coming into effect, certain challenges have emerged. Perhaps most pressing is the way that the new standard mandates accounting for leases. Gone are the days where an operating lease could simply be expensed through the income statement. Leases are now a more complex area that accounting teams have to navigate, and auditing teams will be focusing on.

Any lease modifications, for example, have a ripple effect throughout a company’s lease section, requiring changes across the board.

From those who have been dealing with ASC 842 and IFRS 16 in practice for a while now, some simple yet powerful tips have emerged to help stay on top of lease calculations under these standards:

Embrace technology: manually dealing with leases under ASC 842 and IFRS 16 is becoming increasingly complex, while the stakes are also ever higher and errors or non-compliance lurk in every spreadsheet.

Document extensively: as noted, auditors are going to be focusing a lot of attention on leases, and one of the key calculations is the lease liability. Ensure you have documentation to back up these calculations.

Pay attention to embedded leases: the new standard’s definition of a lease makes identifying all leases more complex, given that an agreement might be a lease in substance even if not overtly identified as such.

Getting confident with calculating your lease liability under ASC 842 and IFRS 16

Under these new standards, calculating the lease liability is fraught with complexities. Any miscalculation here will have a tremendous effect on the business’s financial statements.

This is where automated lease accounting software comes in. Trullion, for example, provides an AI-enhanced end-to-end solution for your leasing function.

It scans leases in PDF or Excel spreadsheet formats to extract pertinent information, prepares audit-ready journal entries, provides all the necessary disclosures, and ensures full visibility for all stakeholders.

Minimize errors, maximize IFRS 16 compliance, and ensure your lease liability calculations don’t keep you up at night. Let Trullion do the heavy lifting for you.