What Is IFRS 16?

Intro – What is IFRS 16?

The IFRS 16 lease accounting standard is a recent standard issued by the IFRS Foundation and the International Accounting Standards Board (IASB) setting out the accounting treatment for leases, including their recognition, measurement, presentation, and disclosure.

IFRS 16 establishes a single lessee accounting model, requiring lessees to recognize assets and liabilities for all leases, with limited exceptions. This unified approach eliminates the previous classification of leases as either operating or finance under IAS 17.

We’ll look at the changes that have taken place in the lease standards, an overview of IFRS 16, calculate the essential amounts that are required by the standard, the impact of IFRS 16, and more.

What’s changed under IFRS 16?

IFRS 16 replaced IAS 17 Leases which was adopted by the International Accounting Standards Board (IASB) in April 2001.

The major changes from IAS 17 to IFRS 16 relate to the way that leases are treated: in the past, leases were split into “operating” and “finance” leases. Finance leases were reflected on the balance sheet while operating leases could be expensed through the income statement.

IFRS 16 removes this distinction and ensures that all leases – with very limited exceptions – are represented on the balance sheet.

It starts with the new definition of a lease: “A contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration.”

The lessee now recognizes a right-of-use asset, as well as a lease liability, and presents these on the balance sheet.

IFRS 16 Overview

IFRS 16 became effective on 1 January 2019. Under IFRS 16, the definition of a lease was broadened, to include contracts that might contain a lease even if this is not explicitly stated.

Within a lease, the underlying asset must be identified, and there has to be the right to use – that is, the right to direct and obtain the economic benefits from the identified asset – over a period of time.

The process is as follows:

- Is there an identified asset?

- Does the customer have the right to the economic benefits flowing from the asset?

- Does the customer have the right to direct the use of the asset of the period?

If the answer to all three questions is “yes,” then the contract contains a lease.

IFRS 16 applies to all listed companies where IFRS is required, being most jurisdictions outside the United States. It is also used by most commercial organizations in these countries even if they are not publicly listed.

Calculating Lease Liability under IFRS 16

How does one calculate the lease liability under IFRS 16?

IFRS 16 states (paragraph 26) that “At the commencement date, a lessee shall measure the lease liability at the present value of the lease payments that are not paid at that date. The lease payments shall be discounted using the interest rate implicit in the lease if that rate can be readily determined. If that rate cannot be readily determined, the lessee shall use the lessee’s incremental borrowing rate.”

There is a lot to unpack here, so we’ll tackle this in sections.

Lease payments: these comprise fixed payments less lease incentives, variable payments (for example that might change based on an index), the exercise price of a purchase option if it’s reasonably certain that the option will be exercised, penalties for terminating the lease, and any residual guarantees expected to be payable.

Present value of lease payments: under IFRS 16, this is determined using the “interest rate implicit in the lease” which is calculated as follows.

The rate of interest (x) such that the following two amounts are equal:

- The present value of the lease payments plus the unguaranteed residual value

- The fair value of the underlying asset plus the initial direct costs of the lessor

If the rate of interest implicit in the lease cannot be readily determined, the lessee’s incremental borrowing rate should be used. This is defined as the interest rate that the lessee would be required to pay should they have borrowed the money to purchase the asset, over a similar term, with similar security, in a comparable economic climate.

IFRS 16 for Businesses

There is a significant impact on businesses brought about by IFRS 16. A large part of this impact is that leases, according to the expanded definition of IFRS 16, can be found in almost any contract.

This means that businesses will have to re-examine contracts for the existence of a lease. While this might sound burdensome at first, many companies have reported that this requirement has actually fostered better communication within the company, as well as educating other business units regarding the finance team’s role and responsibilities.

With IFRS 16 being applicable for a few years now, most organizations have set up the required processes to identify leases and deal with them effectively.

One area that still needs to be improved is when it comes to lease modifications. This can be challenging from an accounting perspective, and many non-accounting departments might not even realize that a lease modification has occurred.

It’s important to bear in mind that IFRS 16 need not be applied in two cases: for leases under 12 months, and for leases where the underlying asset is of low value.

IFRS 16 Impact on Financial Statements

The impact of IFRS 16 on financial statements affects some industries more than others. When IFRS 16 was first introduced, there was a fear that with financial ratios changing, banks might hesitate to extend credit. Now, however, that the standard has been in effect for some time, this is less concerning for most enterprises.

When the standard was first introduced, industries such as airlines, retail and apparel, and shipping and transport saw total assets rise by an average of 14%.

By now this has normalized, as almost all companies are using IFRS 16 (or the corresponding ASC 842 in the U.S.)

IFRS Disclosure Requirements

One of the main reasons that IFRS 16 was introduced, was the perception that leases were an area that was used to hide information from the users of financial statements. Particularly, items were carried “off balance sheet” which was the cause of several accounting scandals.

IFRS 16 states that the objective of the updated disclosure requirements is for lessees to “disclose information in the notes that, together with the information provided in the statement of financial position, statement of profit or loss and statement of cash flows, gives a basis for users of financial statements to assess the effect that leases have on the financial position, financial performance and cash flows of the lessee.”

Therefore, the standard mandates (paragraph 53) that the following elements should be disclosed:

- the depreciation amount for right-of-use assets by class

- the expense relating to short-term leases

- the expense relating to leases of low-value assets a

- interest expense on lease liabilities

- the expense relating to variable lease payments not included in measuring lease liabilities

- all income from subleasing right-of-use assets

- the total cash outflow for leases

- additions to right-of-use assets

- any gains or losses from sale and leaseback transactions

- the per-class carrying amount of right-of-use assets at the end of the reporting period

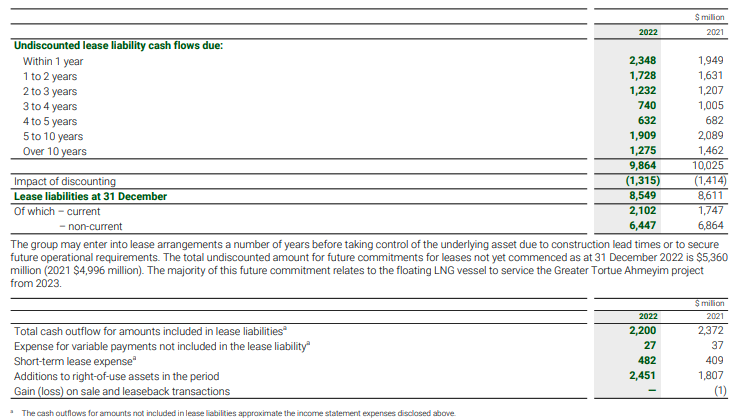

Let’s look at an example, this one from BP, listed on the London Stock Exchange:

Under “Leases,” the company notes the assets it leases, as well as the timing of the undisclosed cash outflows for the lease liabilities on the balance sheet.

Trullion for IFRS 16

As we’ve seen, IFRS 16 may seem simple on the surface, but underneath there is a lot of complexity that’s hidden from view.

From lease modifications to disclosure to contracts containing leases, manually trying to stay on top of lease accounting has become simply untenable for most businesses today.

In almost all cases, the only way to effectively handle leases is by using purpose-built lease accounting software.

This is where Trullion comes in. Trullion’s AI-powered lease accounting solution automates your lease accounting function, ensuring that you and your team are freed up for more high-value work, while you improve accuracy and ensure constant compliance.

You can use Trullion to cover your IFRS 16 needs through:

- Contract upload: upload any type of file with one click

- Data extraction: the system automatically extracts and tags key data such as names, dates, and payment amounts

- Audit trail: everything can be traced back to the source documentation

- Modification detection: detect modifications and automate journal entries

- Audit-ready output: everything is ready for audit, with source data readily available

To find out how you can enjoy the benefits of Trullion’s IFRS 16 solution, schedule a call at your convenience, and a product expert will gladly show you more.