IFRS 16, which was officially released in 2016, replaced a number of previous standards including IAS 17. The standard, which became effective on January 1st, 2019, created a new way to deal with leases. IFRS 16’s stated goal is to “ensure that lessees and lessors provide relevant information in a manner that faithfully represents those transactions,” and give users of financial statements the ability to accurately assess how leases affect the finances of a company.

A key element of IFRS 16 compliance is calculating the ROU (right-of-use) asset. Here, we look at how the right-of-use asset is calculated, and what to look out for when quantifying this asset.

The Right-Of-Use asset in IFRS 16: initial measurement

IFRS 16 stipulates that at the commencement date of the lease, a lessee must recognize a right-of-use asset and a lease liability.

What exactly is a right-of-use asset according to IFRS 16? A right-of-use asset consists of 4 elements:

- The initial measurement of the lease liability (more on this in a moment)

- Lease payments already made, net of lease incentives received

- Direct costs incurred by the lessee

- Costs to dismantle/remove/restore the underlying asset (an estimate)

Clearly, the first step in calculating the right-of-use asset is actually working out the lease liability.

The lease liability is calculated as follows:

- The present value of future lease payments

- Discounted using the interest rate implicit in the lease – if it can be readily determined

- If it cannot be readily determined, the lessee’s incremental borrowing rate should be used

The Right-Of-Use asset in IFRS 16: subsequent measurement

From the commencement date onwards, the cost model should be applied in measuring the right-of-use asset in most cases. The exceptions to this rule are if the lessee applies the fair value model found in IAS 40 (Investment Property), or if the right-of-use asset is part of an asset type where the revaluation model of IAS 16 is applied. In this latter case, the lessee may elect to use that model.

The implication of the cost model is that the asset is recognized at cost, adjusted for accumulated depreciation and impairment, and any remeasurement of the lease liability.

The Right-Of-Use asset in IFRS 16: presentation and disclosure

The stated goal of the disclosure requirements relating to leases is essentially to show the effect that leases have on the financial position, financial performance and cash flows of the company (IFRS 16 paragraph 51).

To this end, the right-of-use asset, according to IFRS 16, must be presented separately from other assets. The standard does allow, however, that if a company does not present the asset separately, it should a) include the right-of-use asset in the same line item that other such assets would be included in, were they owned by the lessee, and b) disclose which line items on the balance sheet (Statement of Financial Position) contain right-of-use assets.

In terms of disclosure, the following needs to be included that relates to the right-of-use asset:

- Carrying amounts of right-of-use assets at the end of the reporting period by class of underlying asset

- Additions to right-of-use assets

- Depreciation by class of underlying asset

Getting a helping hand with your lease accounting

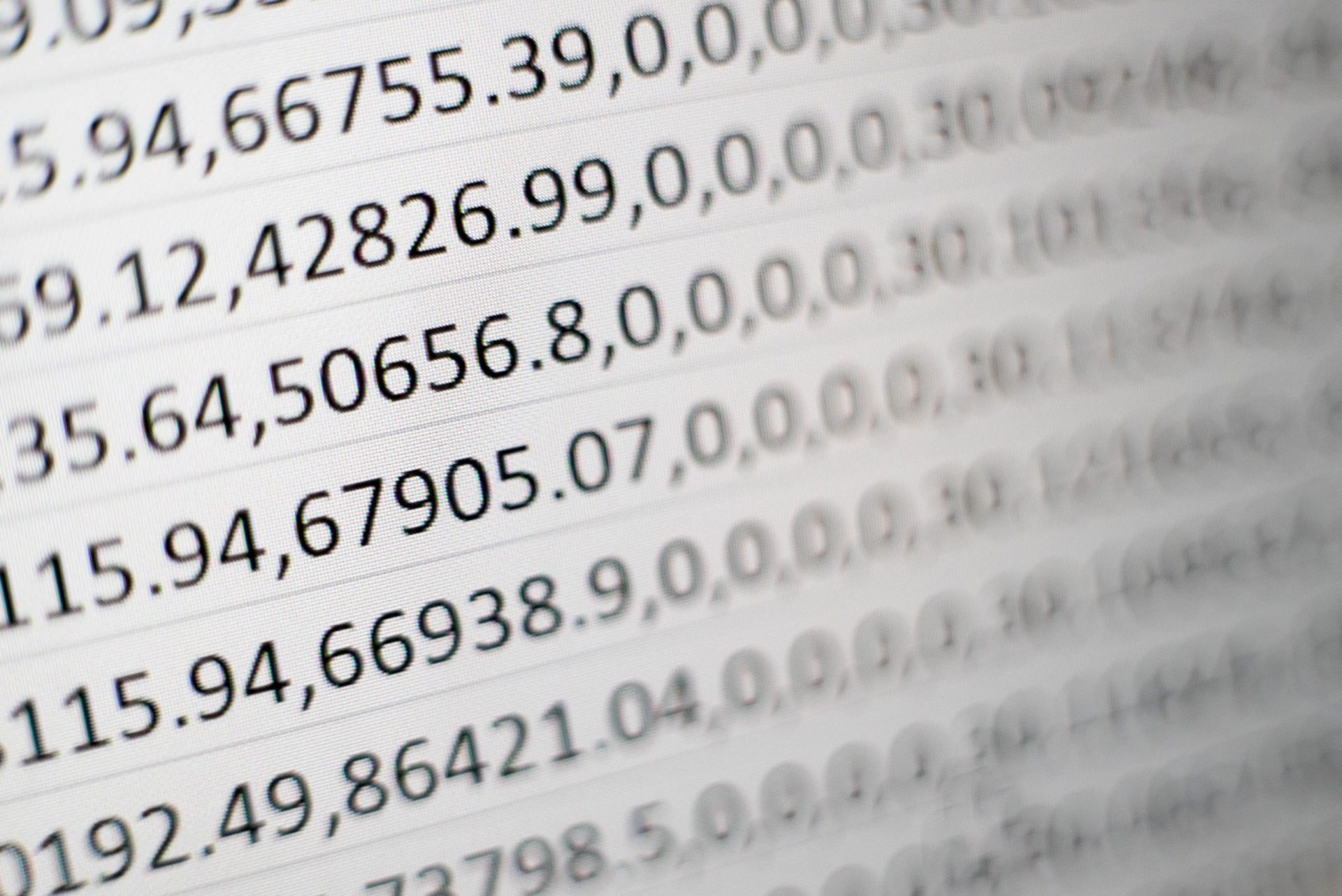

While the method to calculate the right-of-use asset according to IFRS 16 seems straightforward, it can quickly get complicated as the number of leases within the organization increases.

While Excel can help with a small number of leases, there is a point beyond which the manual calculation and management of leases is no longer tenable.

This is where automated lease accounting software comes in. Our AI-powered IFRS 16-optimized solution will take care of your IFRS 16 compliance, including right-of-use asset calculations at scale.

With Trullion, you can scan contracts and the software picks up all the critical data points. It proposes audit-ready journal entries, and is always up-to-date when it comes to new regulations and disclosure requirements.

To find out more, get in touch with us today.