The New Rev Rec is a BIG Change

In 2020, one of the biggest changes in the history of accounting went into effect: ASC 606 (IFRS 15 under international standards). It is best known as the ‘new Revenue Recognition standard’.

For Accountants reading, skip this next paragraph and jump ahead.

For non-Accountants, it’s important to understand: Revenue is king. Not cash. Not bookings. Revenue is a universally accepted metric that lets financial stakeholders understand when a sale of goods is reasonably assured to be collected.

When you check out at the grocery store, revenue can be calculated the moment your credit card is swiped. That’s straightforward. But with larger contracts, or certain verticals, it gets complicated. Contracts are getting more complex and nuanced:

- What if a customer has an ‘opt-out’ clause in the middle of a contract?

- What if you are obligated to deliver a service in the middle of a contract?

- What if your contract has milestones for delivery, like 50% payment upon milestone xyz and 50% payment upon completion?

- What if you’re an energy company that has variable income that changes every month in a contract?

In all of the above scenarios, cash could have been collected by the vendor, but the customer can withhold payment for lack of delivery – or worse, get out of the contract.

Revenue becomes the critical metric for businesses. And with the new Revenue Recognition standard (ASC 606 / IFRS 15) the accounting regulators ensured that businesses account for these risks. It also added complexities around contract acquisition costs, amortizing sales liabilities & vertical-specific rules that could make the head spin.

Thus, a new paradigm was created in 2020:

On a quick Indeed search for “ASC 606”, over 400 jobs show up in the US. If you search “Revenue Accountant”, over 3,500 jobs show up!

Companies also have an incremental cost in software, such as paying for a new module on Oracle, SAP, Netsuite, Workday or other ERP. Even Zuora (NYSE: ZUO), who made their name on revenue recognition, found the complexities of the new standard too complex to build organically! They ultimately acquired Leeyo and rebranded it as ‘Zuora RevPro’.

How Revenue Recognition Exposed a Massive Operational Gap

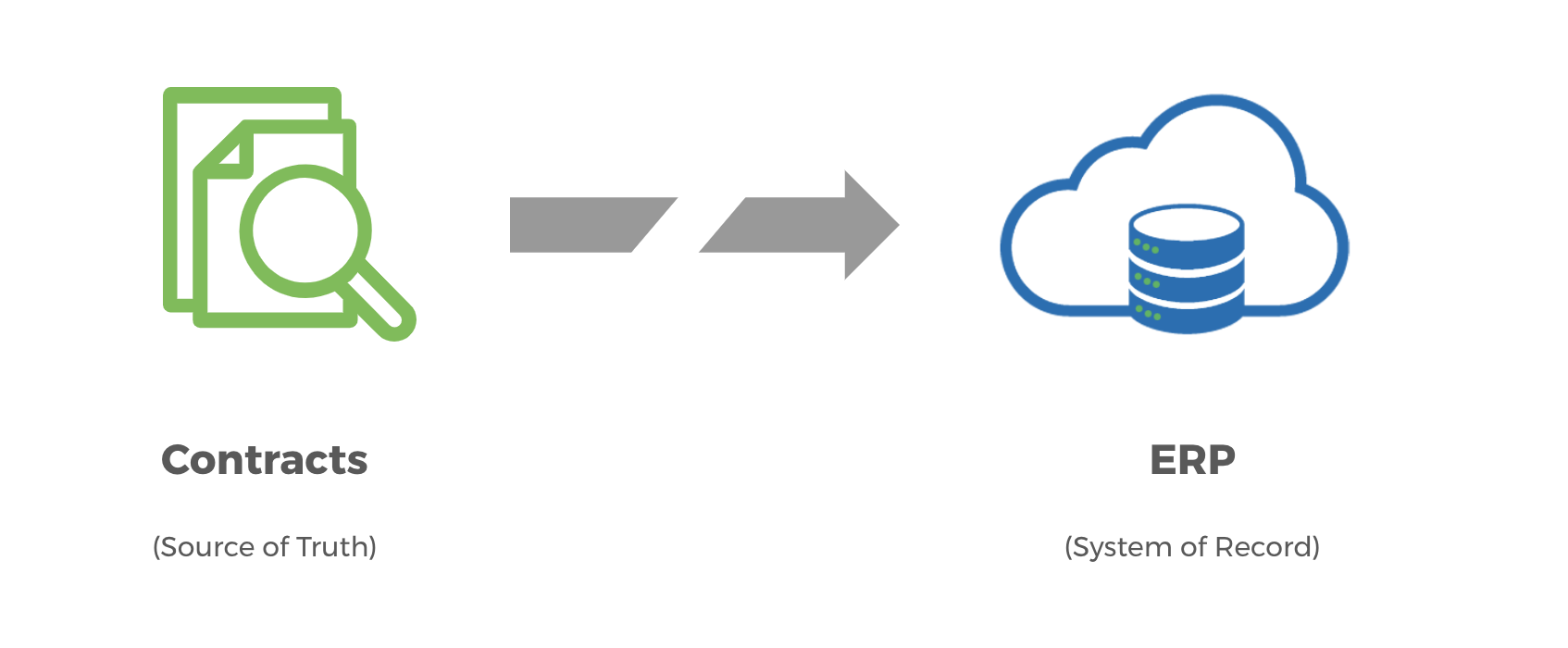

Today, the largest gap in financial operations is between the source of truth and the system of record.

A quick refresher:

- Source of Truth = Contract

- System of Record = ERP

When a contract gets signed, the data gets manually entered into an ERP. Yet challenges arise:

- What if the ERP can only ingest 5 data points, and there are 15 important data points in the contract?

- What if the contract is unique, and takes a while to read?

- What if the data gets manually entered incorrectly?

- What if an amendment is signed?

- What if I get audited?

Companies can spend $10K or $100K or $1m+ on a well integrated ERP ecosystem.

But what about when an investor does diligence? A bank?

They look at contracts! What about when you undergo your annual audit?

Auditors look at contracts (they usually sample a select few).

Reading Contracts Is Half The Battle

For ASC 606, the ongoing challenge is reading contracts and conforming them to the data points you need for revenue recognition. Many companies are even working with their lawyers to change the way they write contracts – just to improve revenue recognition!

With AI Accounting software, there is an opportunity to ingest contracts at a rapid pace and collect dozens of data points. This can be useful for revenue recognition, but also for broader opportunities across the business, such as managing risk and strategy. Above all, it can save up to 70% of our contract reading time and greatly improve accuracy.

Applying Revenue Recognition Rules Is The Other Half

The other half is rules. The rules of revenue recognition – ASC 606 and IFRS 15 – can be extremely daunting in contract-heavy industries.

Take software for example. A CFO will want to know annual and monthly revenue rates. An Auditor or Controller will want to understand the obligations within the contracts – everything from deliverables to cancellable terms – to know when to ‘release’ revenue.

Additionally, there are contract acquisition costs – such as a sales commission – that need to be amortized over the perceived lifetime of the contract.

These are just a few examples of nuances that can have a material impact on accounting for revenue.

To learn more, read about our AI-powered Revenue Recognition software and, schedule a demo with one of our product experts today.