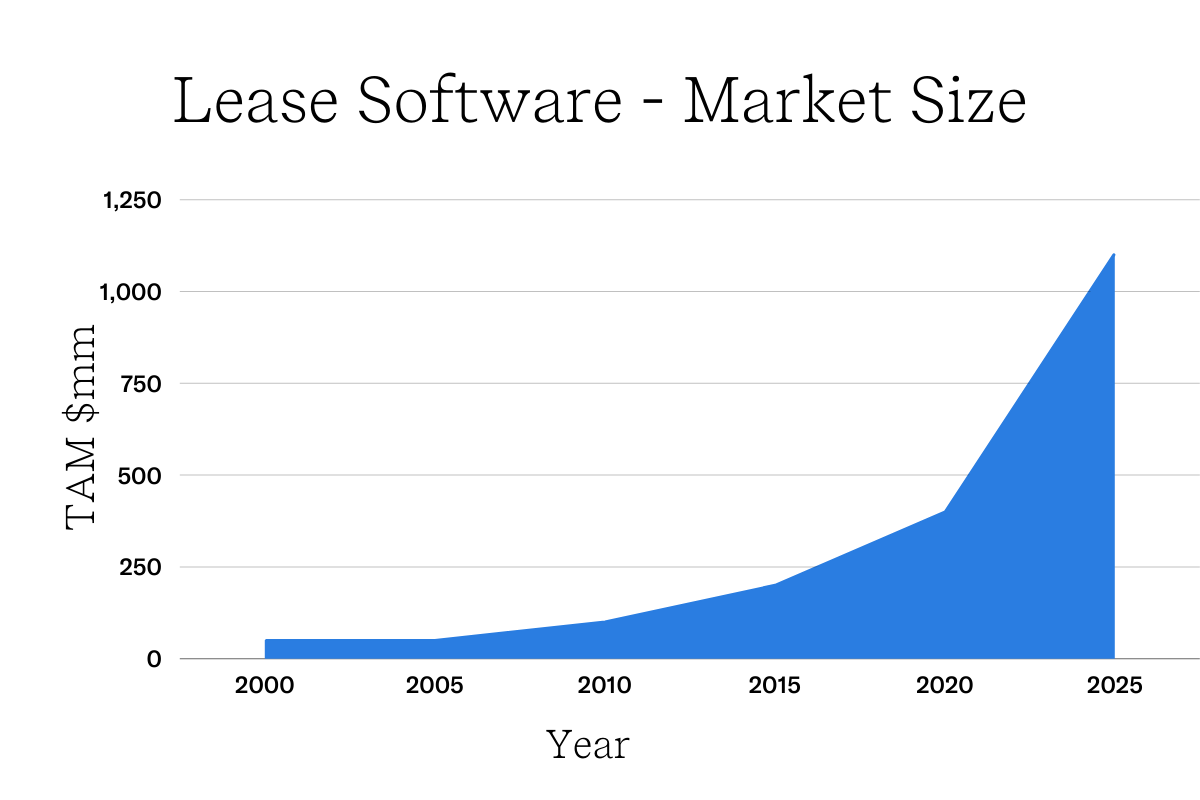

Introduction: The Journey To $1 Billion

Ten years ago, the Lease Accounting Market did not exist. It was a $0 market. There were vendors who supplied Lease Administration Software, but it was focused on corporate tenants with a real estate footprint. In 2011, a lease administration software called Virtual Premise was acquired by CoStar – a public real estate company – for an estimated $17m all-cash transaction. The software was rebranded to CoStar Real Estate Manager and became a quiet product line in a $1 billion dollar public company.

By 2020 – ten years later – the Lease Accounting software market was worth $400 million. By 2025, the expected size of the market is:

$1 Billion Dollars

$1bn for Lease Software? What is Lease Accounting, and where did it come from?

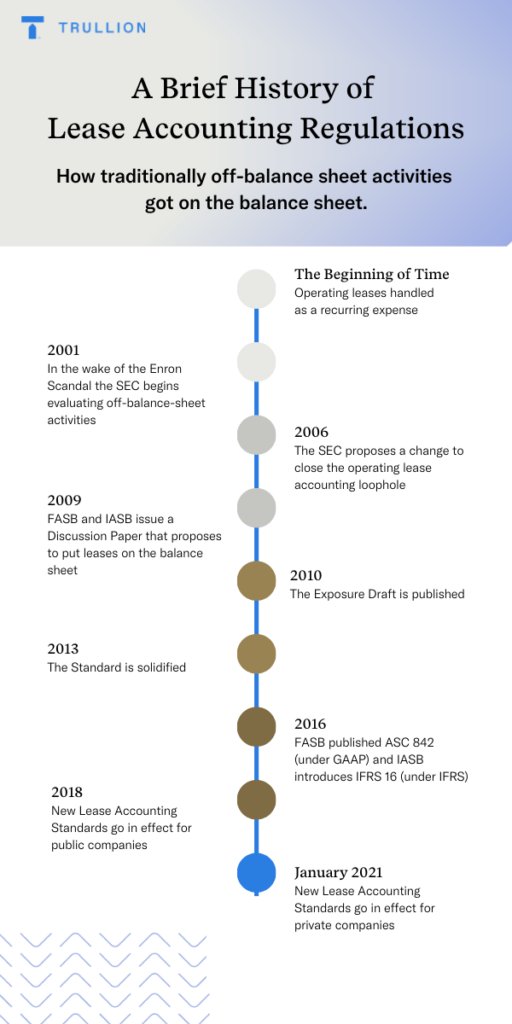

It Started Out With A Shift. A Regulatory Shift.

For decades, leases were handled as an Expense – ie. off of the Balance Sheet. An office lease got signed, or a truck got leased, and you paid the regular expenses monthly. Just like any expense: a SaaS agreement, your marketing agency, the water cooler delivery service.

In 2001, in the wake of the Enron scandal, the SEC began evaluating “off-balance sheet” activities.

In 2006, a change was proposed to close the lease loophole.

In 2009, the FASB and IASB issued a Discussion Paper that proposed to put leases on the balance sheet.

In 2013, the standard was solidified.

In 2016, FASB published ASC 842 (under GAAP) and IASB introduced IFRS 16 (under IFRS).

To simplify, these new standards change 3 key things:

- Leases Go On The Balance Sheet. Instead of a straight-line expense (ie. one-time setup), the lease payments would be forecast over their expected lifetime. Then, a complex test would be administered, including applying an interest rate. The resulting Liability would be calculated and updated regularly (ex. Monthly journal entries).

- More Data Required from Lease Contracts. Instead of just a Start Date, End Date, and basic Payment Stream, GAAP & IFRS would now require multiple payment components, negotiated incentives, allowances, options, terminations, and other items buried into the contract.

- Annual Disclosures Required. Instead of a small asterisk on a 10K filing, a 20+ line quantitative disclosure would be required that speaks to the nature and risk of leases.

When is the Deadline?

Public companies were required to adopt January 2019, including both GAAP & IFRS. Private companies were required to adopt in January 2020. However, the standard for private companies got delayed** twice until January 2022.

**Interestingly, the FASB Chair Russ Golden said he was “disappointed” that many software companies weren’t ready for the lease accounting rules. Technology Could Slow Pace of New Accounting Rules (WSJ, June 2019)

What is the Impact on the Accounting Industry?

A regulatory shift like this can have a significant impact. Every audited company has at least 1 lease. Therefore, there is an incremental increase in their workload – for some, it will take a few additional man-hours, for others they will fund new full-time positions. For auditors, they need to add a new workflow to the annual audit.

At a macro level, the new Lease Accounting regulations will shift $3 trillion of capital onto the Balance Sheet, according to the Financial Times.

At a practical level, an estimated 50,000 companies have adopted – or plan to adopt – a software solution to help comply with the new Lease Accounting standards. This is known as “Lease Accounting Software”, which brings us one step closer to our understanding of the $1bn market.

Shouldn’t Companies Just Do This With Spreadsheets?

Perhaps . If they have less than 10 leases. Or a small portfolio of very simple leases. But once you get past 10 leases, the task of updating monthly journal entries and patching annual disclosures requires rule-based software. Keep in mind the standard goes beyond office leases and includes equipment – cars, forklifts, servers, telecom, medical devices, etc – and leases embedded within service contracts.

Any significant change in a lease – term, payments, options – requires a company to apply modification accounting, which adds a layer of complexity that a spreadsheet may not be able to handle.

For public companies, they may need to show more information in a SOX-regulated environment – such as User Controls and Audit Trail.

So, Companies Are Forced To Use Software?

Yes. Lease Software allows you to manually type in your lease data, answer a few questions about each contract, and *poof!* out comes your monthly journal entries and disclosures.

Is This Why Lease Software Is a $1bn Market?

Yes. Imagine you’re an N95 mask company on the verge of a Covid breakout. You’re going to be in demand.

Has There Been Investment Activity?

Here is the list of Corporate Development activity in the past couple of years:

| Year | Vendor | Investor | Investment Amount (Est.) |

| 2017 | AMTDirect | Luminate Capital | $10m+ |

| 2017 | Lucernex | Accruent | Acquired |

| 2018 | Visual Lease | Growth Street | $5m+ |

| 2018 | LeaseAccelerator | Insight Partners | $30m+ |

| 2019 | ProLease | MRI | Acquired |

| 2019 | Visual Lease | Spectrum Equity | $20m+ |

| 2019 | LeaseQuery | Goldman Sachs | $40m+ |

| 2020 | AMTDirect | MRI | Acquired |

| 2020 | Trullion | Greycroft/Aleph | $4m+ |

Why Are So Many Private Equity Firms Investing?

As we see above, nearly all of the investment comes from Private Equity firms focused on legacy businesses, or corporate buy-outs by MRI. This may be related to 1) Maturity of the businesses, and 2) Private Equity’s understanding of compliance-driven businesses, often in back-office operations. For perspective here are the years when the most established lease software companies were founded ️:

1992 Dodge Caravan

1992 Dodge Caravan

- 1990. Nakisa

- 1992. ProLease

- 1995. Visual Lease

- 1996. AMTDirect

- 1999. Virtual Premise (CoStar)

- 2000. Lucernex

- 2000. Tririga

- 2000. LeaseAccelerator

- 2011. LeaseQuery

- 2018. Trullion (AI Powered Lease Accounting)

VCs, on the other hand, tend to focus on upstart companies whose growth is supported by innovation and disruption. Nearly all of the above players fall into a category of software companies whose growth is bolstered by this regulatory event, regardless of whether they originated in Real Estate, Equipment, Retail Leasing, or other adjacent verticals.

How Does the ERP Ecosystem Change?

In short, more manual entry – and loosely integrated. Oracle, SAP, and Workday did not bring a solution to market. Nor did Microsoft, Sage Intacct, Netsuite, INFOR, Workday, and others. Some have ISV partners who created modules within their API ecosystem.

It’s expected that there will be an additional $1bn+ annual labor market created, related to entering and maintaining leases into ERPs or sub-ledgers. There are also global accounting firms that offer managed services around maintaining a manual entry process and an ERP ecosystem.

How do Accounting Firms Capitalize?

The accounting services industry is a $200bn+ annual market largely comprising audit, tax, and consulting services. Over $150bn is attributed to the Big 4 accounting firms: E&Y, PwC, Deloitte & KPMG. Accounting firms are taking mixed approaches: some see it as an opportunity to commit resources (ie. people) through services such as contract reading, data entry, process help, spreadsheet reviews, and reconciliation. Others view it as an opportunity to build, license, or partner with technology. Some are even leveraging advances in AI and Machine Learning to reduce the total cost of ownership for their clients.

In the Big 4 arena, each firm has its own approach.

- Ernst & Young is independent under what they call “the next big accounting change”. They are leveraging AI for Lease Review.

- PwC is independent and offers AI Contract Analysis in various areas.

- Deloitte. Deloitte markets their own software called LeaseController as well as LeasePoint, which appears to be an add-on to IBM Tririga. Also, they have a product called LeaseMARC.

- KPMG. KPMG offers the KPMG Leasing Tool which connects with IBM TRIRIGA, with “multiple Fortune 100 clients” using.

As you move past the Big 4, other firms are entering the Lease Accounting market:

- Grant Thornton. They’ve created a portfolio of tools. LeaseCom Analytics helps reconcile a lease sub-ledger with an ERP. They also have LeaseTax to solve tax implications.

- Crowe Horwath. Crowe has created the Lease Optimizer, which is a manual-entry sub-ledger for Microsoft Dynamics and NetSuite ERP users.

- BKD. BKD launched LeaseVision, an AI-powered solution. They leverage a 3rd party Legal AI tool – Kira – to extract data, and then create reports in MS Excel.

A $3 Trillion Accounting Shift Creates a $1 Billion Software Market + $$ Million Labor Market

As you can see, a small accounting shift has sent $3 trillion on the balance sheet and a $1bn lease software spend market for companies. This has also created a new labor market to manually manage the lease data around the ERP, and accounting firms to check the work.

Bonus: Beyond Compliance, Is There Value in Organizing Lease Data?

One of the mandates of CFOs and Controllers is cost control. The average Fortune 1000 company has between $100m and $1bn in lease liabilities. So managing these in software – rather than PDFs or spreadsheets – can bring powerful efficiency.

The new regulations could usher in an era of smarter operational efficiency for accounting leaders that will make that otherwise eye-catching $1bn market size just the tip of the iceberg.