Lease accounting has changed tremendously over the past few years, with key accounting standards in this area being completely overhauled. Software for lease accounting has also advanced – in fact, it’s tremendously challenging to manage leases and comply with the relevant accounting standards without software for lease accounting in place.

So, what should you look for when comparing software for lease accounting? We’ll go through everything you need to know.

Lease Accounting Standards

First, it’s important to understand the background and context behind the recent changes to lease accounting standards, as this impacts the decisions you’ll make around which software for lease accounting to choose.

Rewind to the early 2000s, and the accounting and auditing world was being rocked by a number of scandals. So much so that what used to be the “Big 5” audit firms became the “Big 4” after Arthur Andersen ceased to exist after the Enron scandal. Much of this turbulence could be traced back to off-balance sheet financing, and specifically taking advantage of relatively loose rules around leases to “hide” certain balances.

The global accounting and audit bodies realized that something had to change, and they embarked on a process that eventually led to FASB ASC 842, IFRS 16, GASB 87, and other accounting standards.

The main aim was to ensure that users of financial statements saw the full picture when it came to an organization’s leases, and this required dramatic shifts in how leases were accounted for – including raising new assets and liabilities on the balance sheet. This, however, was just part of the new requirements for leases, as this area became very complex, very quickly.

Which is why software for lease accounting became mission-critical.

Read the Guide to Implementing ASC 842.

Why use software for lease accounting

There are numerous compelling reasons why companies should use software for lease accounting compliance. These include:

Complexity

With the definition of a lease changing, and any contract having the potential to contain a lease under the new definitions (including an embedded lease,) suddenly leases became a lot more complex. This is in addition to new calculations that have to be performed, and lease modifications as defined in the standard which add an additional layer of complexity.

Time

Along with complexity comes a time element; in the past, leases could be relatively easily managed with simple spreadsheets and regular journal entries that expensed operating leases through the balance sheet. Today however, this process can be extremely time consuming, if software for lease accounting is not used.

Audit

With accounting standards such as ASC 842 becoming applicable very recently, this is naturally an area that auditors will be focusing on. Having lease accounting software in place ensures compliance for public companies and private companies. Financial reports allow auditors and other stakeholders to easily trace journal entries back to source documents. With such a solution in place, both the auditors and the client can breathe easily, knowing that compliance is taken care of.

Features of Lease Accounting Software

Not all software for lease accounting is relevant for every organization. For example, smaller companies with only one or two leases might still be able to use Excel exclusively to manage their leases, or use a more basic software solution for lease accounting. For medium and large organizations, a comprehensive lease accounting software solution is going to be necessary. When comparing lease accounting software providers here are the things to look for:

Automation

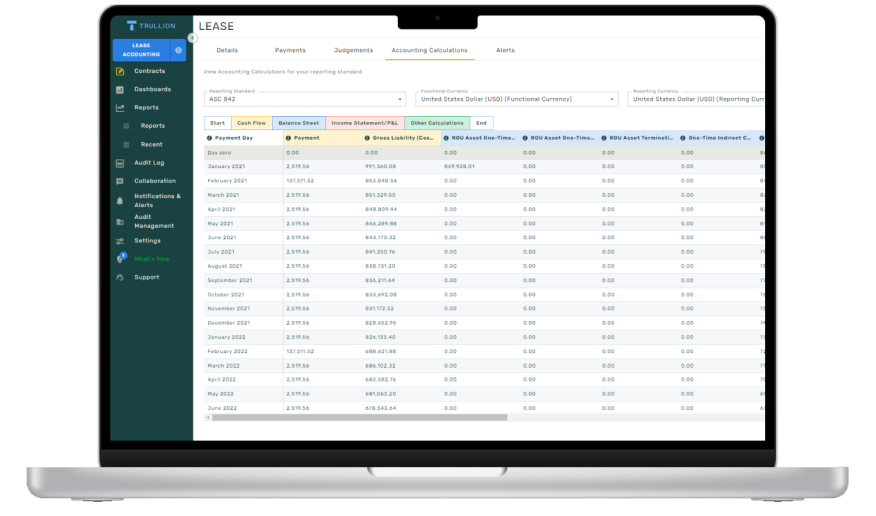

The first test is whether the software for lease accounting actually makes your life easier is whether it is an intuitive automation tool. Some software, especially solutions that predated ASC 842 and IFRS 16, are clunky, difficult to use, and just result in doing double the amount of work. Truly automated lease accounting software does exactly the opposite; it takes care of the heavy lifting for you. For example, you’d be able to scan a PDF contract, and the software will automatically extract important dates and amounts, and even generate audit-ready journal entries.

Integrations

Does the software for lease accounting integrate with your current systems? Look out for solutions that are “plug & play” and don’t require heavy integrations and long training periods.

Visibility

Software for lease accounting should ensure visibility to all stakeholders. Part of a smooth experience that such software promises, is removing the back-and-forth within the company, and between the company and its auditors. What you’re looking for is one source of truth.

Security

On the other side of the visibility coin is security. Ensure that the software you’re evaluating has got the right security certifications such as SOC 2.

Efficiency

With the right software for lease accounting in place, you can take your efficiency and productivity to the next level, freeing you up for high-impact activities such as influencing the strategic direction of your company. Look for lease accounting software that will:

- Seamlessly meet the relevant lease standard compliance requirements

- Produce accurate and consolidated lease analysis reports in minutes

- Effortlessly trace your audit trail back to the source data

- Offer clear reports and financial obligation schedules

Choosing software for lease accounting

Now that we’ve looked at why software for lease accounting software is so important, along with what to look out for when comparing software for lease accounting, the final step is evaluating various options when it comes to software for lease accounting.

One of these should be Trullion: Trullion was created from the ground up to specifically help organizations of all sizes manage their lease accounting, and using automation Trullion ensures that you minimize risk, enhance compliance, and increase efficiency.

If you’d like to speak to a Trullion representative, get in touch today.