What is ASC 842?

ASC 842 is the new lease accounting standard that replaced ASC 840 in 2019. The goal of ASC 842 is to provide greater transparency and comparability in financial reporting by requiring public business entities and private companies to recognize lease assets and liabilities on the balance sheet. This will give investors and owners a better understanding of a company’s financial position and performance.

The introduction of ASC 842 has had and will have a significant impact on all U.S. companies. The new lease accounting Standard was introduced by the FASB primarily to streamline accounting for leases, reduce “off-balance-sheet” activities and enhance transparency around lease contracts. It also takes into account a world in which heavy upfront capital expenditures have given way to “as-a-service” offerings such as SaaS (software as a service) and MaaS (mobility as a service).

Accounting for Finance Leases vs. Operating Leases

While many elements particularly of finance leases are treated essentially in the same way as dealing with in ASC 840, it’s operating leases that are most affected by ASC 842. For companies, this poses additional challenges: while finance leases are relatively easy to spot and account for, operating leases are not; and are present throughout the organization. From the IT department through operations, and from marketing to sales and even the finance department, operating leases – at least those that are defined as such under ASC 842 – are to be found almost everywhere.

ASC 842 Implementation and Compliance

It is up to finance teams and auditors to ensure that all leases are identified and accounted for correctly. This task can be daunting. In fact, without lease accounting software solutions in place, for some businesses it’s almost impossible. The big question is, “Where to start?” To assist, we’ve compiled a practical readiness checklist that will ensure you’re properly prepared for the implementation of ASC 842.

Use these quick links to find the section you want to read:

1. Understand ASC 842 and Its Implications

2. Assess all Contracts for Lease Elements

3. Ensure Your People are Ready for ASC 842 Adoption

4. Ensure You Have the Right ASC 842 Software

Conclusion: Preparation can Ensure a Smooth ASC 842 Implementation

1. ASC 842 Summary

Understanding the principles of ASC 842 is something we often emphasize. By understanding why the standard was first introduced, and how it deals with many lease-related issues, you’ll be in an excellent position to implement it. Too many companies were using off-balance sheet financing to present an inaccurate picture of their financial reality, often with the use of leases. For example, a company might want to buy a new machine, but doing so outright would drive key ratios such as the debt-to-equity ratio over a predetermined level, and trigger creditors to call in loans.

So instead of borrowing the money – increasing liabilities on the balance sheet and negatively affecting financial ratios, the company sets up a Special Purpose Vehicle (SPV) which buys the asset and then leases it back to the company. Voila! No liability, just an expense through the income statement.

One of the most infamous off-balance sheet financing cases was the multi-billion dollar implosion of Enron.

All of this was possible and in many cases legal, until Sarbanes-Oxley, IFRS 16, and ASC 842 put a stop to it.

While ASC 842 was initially delayed, it’s now crunch time as the Standard – or “Topic 842” as it’s also called – is effective for annual reporting periods beginning after December 15, 2021 (even though it can already be adopted). With the Standard becoming applicable, companies are going to have to ensure they’re prepared for the changes ASC 842 brings.

This means first and foremost understanding the essence of ASC 842, and the changes that it requires both in general approach and practical implementation.

Key elements of ASC 842 to note:

- A lessee shall recognize all leases with a term greater than 12 months on its balance sheet

- The definition of a lease including the key concept of “control” of an asset

- Treatment of leases in terms of initial and subsequent measurement, and disclosure

- Specifically the initial creation of a lease asset (a “right-of-use” asset or ROU) and liability, the present value of lease payments and the correct discount rate to use

- The implication of “reasonably certain” lease renewals and purchase options

- Disclosure requirements (both qualitative and quantitative) including discussions of the leases, significant judgments made, information on lease-related costs in the Income Statement and analysis of discount rates used

While these are important elements, they are of course not a substitution for the full text of FASB ASC 842. That’s why Step 1 of the checklist is all about familiarity with the Standard. For helpful and more detailed references, check out guidelines produced by the Big 4 accounting firms.

Two transition methods are available: beginning of earliest comparative period affected, or the effective date. In terms of these transition methods, a great example is Apple who delineated their transition method chosen, and its impact.

In its annual report, under “recently adopted accounting pronouncements”, the company stated: “At the beginning of the first quarter of 2020, the Company adopted the Financial Accounting Standards Board’s (the “FASB”) Accounting Standards Update (“ASU”) No. 2016- 02, Leases (Topic 842) (“ASU 2016-02”), and additional ASUs issued to clarify and update the guidance in ASU 2016-02 (collectively, the “new leases standard”), which modifies lease accounting for lessees to increase transparency and comparability by recording lease assets and liabilities for information about leasing arrangements. The Company adopted the new leases standard transition method, under which amounts in prior periods presented were not restated. For adoption, the Company elected to not reassess (i) whether any are or contain leases, (ii) lease costs. Upon adoption, the Company recorded $7.5 billion of right-of-use (“ROU”) assets and Condensed Consolidated Balance Sheet.” (emphasis added)

The practical implications of these changes in dealing with leases are that all contracts have to be re-assessed in light of the requirements of ASC 842.

2. Assess All Contracts for Lease Elements

This is one of the toughest parts of implementing ASC 842. Leases, under the definition of the Standard, can be present everywhere, and are often among the first elements to be affected by business decisions.

For example, during and after the COVID-19 pandemic, many businesses downsized their real estate footprint, or modified existing agreements. While taken as a business decision, this directly impacts the accounting treatment of leases.

This type of example shows how prevalent and indeed central leases are to any organization’s operations, and how all areas can be affected. In IT it might be servers and other equipment, for Operations it might be specific machines, or service contracts.

Another important element to consider is your organization’s migration to the cloud. If it has migrated recently or is planning to do so in the near future, you should consider the implications of ASC 842 along with ASC 350 “Intangibles– Goodwill and Other” and look at how you can most effectively structure such arrangements from both a business and accounting perspective.

One element that is commonly missed is an embedded lease. An embedded lease occurs within a contract where in actuality there is a lease agreement, even though the word or concept “lease” might not appear.

Questions to ask in order to ascertain if there might be an embedded lease within the contract include:

- Does the contract refer to the use of a specific asset? (Note that this has to be a named, specific asset)

- Can the supplier of the asset substitute it with a different asset?

- Control: this is key area for defining an asset; does the organization in

question control the asset or have a right to control the asset?

Terms that may help to look out for within contracts are “exclusive use,” “sole use,” or identifiers like “Machine 2451.”

Essentially across all business units, contracts have to be re-examined to see if elements fall under ASC 842.

Doing this manually can be daunting. An organization can have hundreds if not thousands of contracts, in a combination of PDF and Excel spreadsheet formats. That’s why the software you choose to manage your lease accounting is going to be critical.

But before we talk about technology, let’s talk about people.

3. Ensure Your People are Ready for ASC 842 Financial Reporting

ASC 842 compliance is going to require not only the commitment of the finance team, but will be best served by ensuring everyone is on the same page across the organization.

We know, it can be notoriously difficult to get other departments to think about things like accounting compliance (just try getting invoices from them!)

With that being said, communicating effectively with the people in your organization will pay dividends.

You need to be informed when new contracts are entered into, have a list of existing contracts, be informed when conditions within contracts change (for example an early payback), or when contracts are canceled.

Specific attention needs to be paid to conditions where a contract is for under 12 months (and therefore not required to be recognized under ASC 842) but where renewal is reasonably certain – thus bringing the lease within the purview of ASC 842. Additionally, your asset registers or lists should be constantly checked for additions or deletions, and their effects from a lease perspective.

We recommend implementing training programs for the finance team, and where practicable, other key company employees. Having “allies” trained in the details of the new Standard will ensure that issues pertaining to leases are more likely to be picked up early.

Similarly, it will be critical to put processes and internal controls in place to ensure that leases are being dealt with correctly and effectively throughout the organization.

This seems like a lot of work, we know. The next step is all about leveraging technology to ensure full ASC 842 compliance.

4. Ensure You Have the Right ASC 842 Software

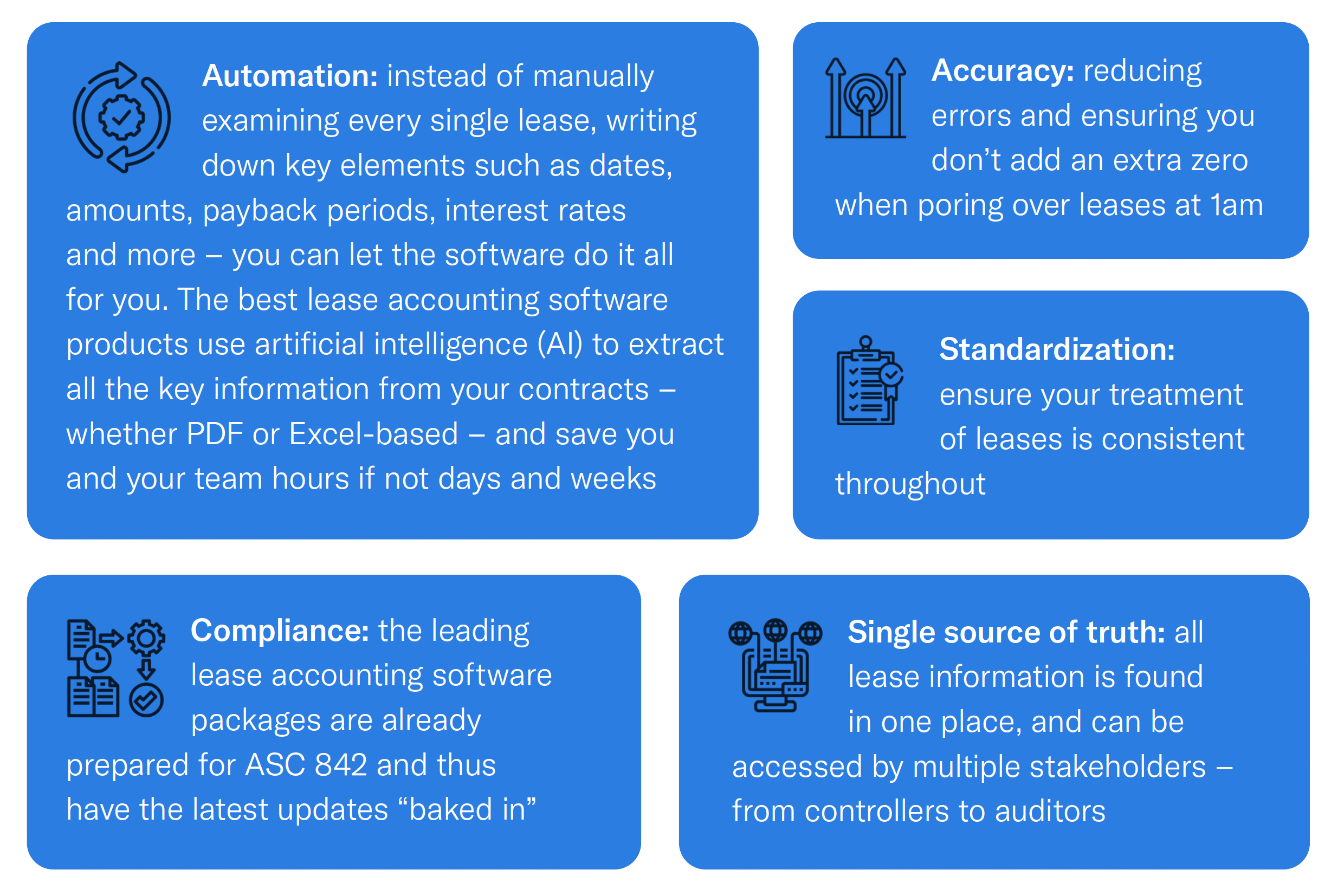

Using the right technology can turn compliance from an absolute nightmare into a super smooth process. Today there are specific lease accounting software products that are built especially for making the process around accounting for leases a seamless one.

Leveraging software has a number of key advantages. These include:

Sure, Excel is awesome. We love it. And it will always have its place in accounting and auditing. However, by itself, it might not be enough. Especially as complexity around lease accounting grows, we highly recommend implementing a purpose-built lease accounting software solution.

5. Prepare for Audit

It’s one thing to be on top of things internally. It’s quite another to be audit-ready. So in preparing your lease calculations – hopefully using a software solution as discussed in the previous point – you have to ensure that the audit team can easily inspect all calculations.

Auditors will want to inspect journal entries, disclosures, as well as the calculations themselves. This is another compelling reason to use lease accounting software, as it precludes the need to update multiple documents in different places – saving time and money, and avoiding costly errors.

Additionally, the auditors will review the assumptions and calculations around determining the interest rate per the various contracts. Just as a reminder, the lessee should use the discount rate implicit in the lease but if this cannot be readily determined, the lessee’s incremental borrowing rate or IBR should be used.

Even disclosures are a subject that impacts areas outside of pure leases. For example, in addition to the quantitative and qualitative disclosure around leases, companies will have to disclose information about leases that have not yet started, any related-party lease transactions, sale-and-leaseback transactions (including gains and losses), maturity analyses, and information on lease terms and discount rates.

Auditors are just one set of stakeholders. Which other stakeholders are affected?

6. Align all Stakeholders

Being on the same page is key when it comes to compliance with new requirements in general, and ASC 842 in particular.

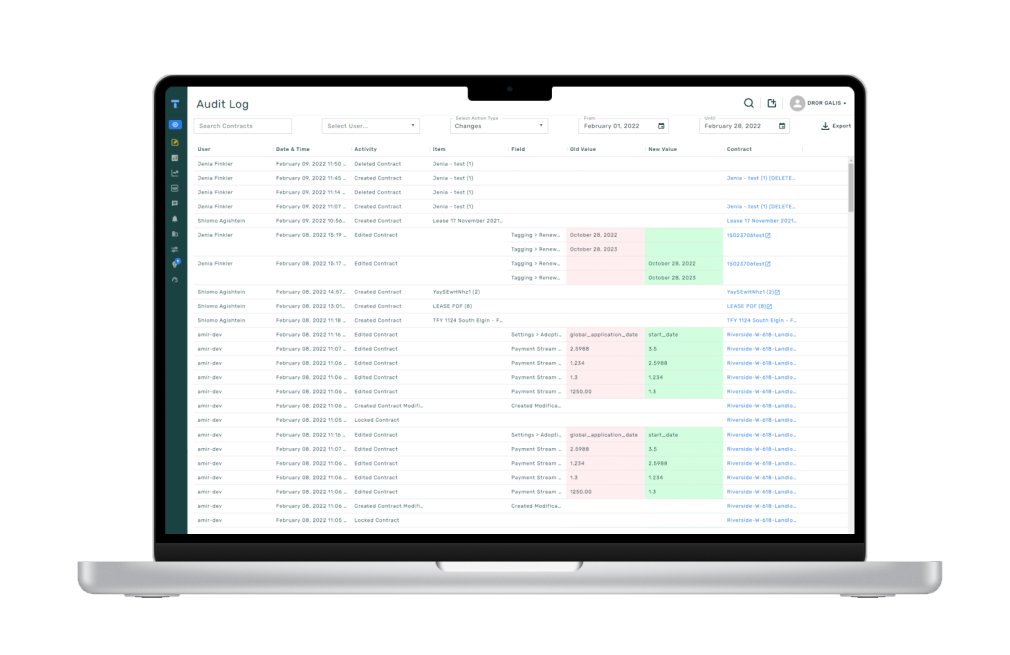

This is within the finance team, and with trusted partners and auditors. Having visibility and transparency into leases – indeed, the reasons this new Standard was introduced in the first place – is critical. Ideally you should have a unified platform with a live audit trail that can be accessed by anyone with the necessary credentials.

It might not seem like it at first, but multiple stakeholders are affected by the implementation of ASC 842. For example, with this change, key balance sheet ratios are likely to change. This impacts shareholders, potential investors, lenders, analysts, suppliers and others.

We recommend setting up an implementation timeline, which should also include communication with key stakeholders both internally and externally.

Already public companies are required to adopt ASC 842, so it’s instructive to see how they have implemented and disclosed their leasing-related transactions.

Microsoft, for example, noted that, “The standard will have a material impact on our consolidated balance sheets, but will not have a material impact on our consolidated income statements. The most significant impact will be the recognition of ROU assets and lease liabilities for operating leases, while our accounting for capital leases remains substantially unchanged.”

In looking at Apple’s recent annual report, we can see disclosure in terms of:

- General information regarding the company’s leases (“The Company has lease arrangements for certain equipment and facilities, including retail, corporate, manufacturing and data center space…”)

- Lease costs and payments

- A table showing ROU assets and lease liabilities along with the related financial statement line item

- Lease liability maturities for the next five years

- Weighted average remaining lease term

- Future expected lease payments

Part of aligning stakeholders is to ensure everyone is pulling in the same direction, and that there aren’t surprises or recriminations down the line. For example, the Board should be prepared to face new numbers and disclosures, and should be educated in terms of how the new leasing Standard is and will be implemented.

Ensure a Smooth ASC 842 Implementation

As you’ve read and checked off the various sections, we hope you’ve come to realize that with the right preparation in place, implementing ASC 842 can be painless. The implementation process requires planning, communication, and leveraging technology – specifically AI-based lease accounting solutions – to get the job done.

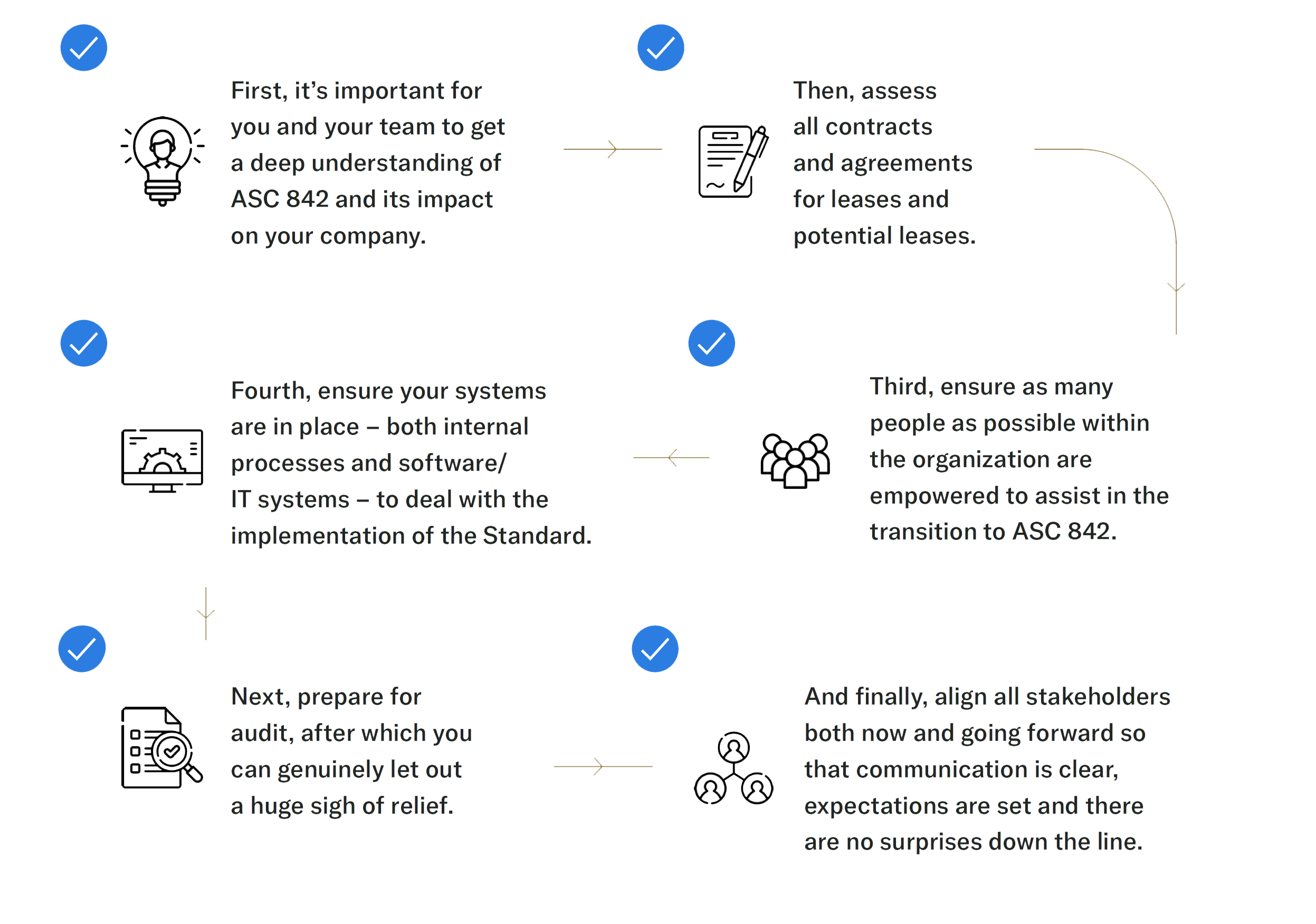

ASC 842 Preparation Checklist

- Understand ASC 842 and its impact on your company.

- Assess all contracts and agreements for leases and potential leases.

- Ensure as many people as possible in the organization are empowered to assist in the transition to ASC 842.

- Ensure your systems are in place to deal with the implementation of the lease accounting standard – both internal processes and software/IT systems.

- Prepare for audit.

- Align all stakeholders now and in the future so communication is clear and expectations are met going forward.

We hope that with this checklist, you’ll be on your way to a smooth ASC 842 transition.

The ASC 842 finish line is just up ahead. You’ve got this!