As a leader in an enterprise company, you know that increased size and complexity mean that an “ordinary” challenge for a smaller organization is multiplied by orders of magnitude in a large enterprise. A prime example of this is lease accounting.

Thanks to updated lease accounting standards, specifically ASC 842 and IFRS 16, not only do all leases have to be dealt with in a more sophisticated way, but many contracts that don’t even mention the word “lease” can fall under the definition of a lease according to these standards (i.e. an embedded lease).

Now, as an enterprise, you’re probably using some kind of lease accounting software. Read on to explore why you should reevaluate this software, what this software should be doing for you, and how to get the most from your lease accounting software provider.

The current state of lease accounting software

The adoption rush

With the launch of updated lease accounting standards, there were changes made to processes and outcomes that altered decades of accounting practice. The most obvious of these was the move to bring almost all operating leases onto the balance sheet through the lease liability and right-of-use (ROU) asset.

This also meant that there was much uncertainty around how leases should be accounted for and what effects these would have on key financial ratios, among other concerns.

Taken together, it’s no surprise that companies rushed to get lease accounting software onboard to ensure compliance.

However, now that the dust has settled, many of these companies – and particularly enterprises – have discovered that the lease accounting software solution they chose during this rush is actually not suitable for their needs. More than this, there are solutions out there that not only ensure compliance, but also add a tremendous amount of value. This is in the form of insights, interface, time spent on lease accounting, cost savings, how leases are input into the system, and much more.

Current problems with existing solutions

The problems with many existing solutions, especially those that are not up-to-date, can cause major issues. It’s safe to assume that you have already encountered many of these in your day-to-day role:

Lack of flexibility

Many legacy lease accounting systems may not adapt well to changing lease terms, different types of leases, or constantly-changing regulatory requirements. This rigidity has a knock-on effect, as every time there is a change that the software can’t deal with, it means more time wasted, more support required, and often more money spent. It also raises doubts regarding the ongoing compliance of a company’s lease accounting process.

Integration issues

Integration issues are unfortunately all-too-common with many lease accounting software solutions. These systems often struggle to seamlessly integrate with other financial systems or databases within an organization. This lack of compatibility can lead to data silos, inefficient workflows, and a higher likelihood of errors due to manual data entry or transfer between systems.

Time

The time involved in managing leases with certain software solutions can be exorbitant. For instance, adding a new lease might take an unreasonable amount of time, with customers reporting a two-hour process for a single entry (and worse). This inefficiency can significantly hamper productivity, especially for businesses with a large number of leases to manage. This time has a real cost in terms of hours spent, as well as the opportunity cost of high-value, high-impact work that is not being done so that lease accounting can be taken care of.

Customer support

Customer support is a critical aspect of any software solution, and it’s particularly lacking in some lease accounting systems. In extreme cases, some lease accounting providers no longer support their products, leaving users without essential assistance for troubleshooting, updates, or navigating complex features. Great customer support is vital for resolving issues quickly and ensuring the software continues to meet the evolving needs of its users.

Limited reporting capabilities

At the end of the day, all the accounting work your team carries out is reflected in your financial reporting. And yet, many lease accounting software providers offer extremely limited reporting capabilities, nevermind the ability to generate insightful, detailed financial reports. This limitation restricts the analysis of lease data, hinders decision-making processes, and makes it challenging to provide stakeholders with comprehensive lease information.

Compliance

Compliance is another area where some lease accounting systems fall short, especially in terms of adhering to specific lease management requirements as opposed to broader compliance requirements. These systems may not be updated promptly to reflect new regulatory changes or may lack the sophistication to handle complex compliance needs, putting companies at risk of non-compliance.

Scalability

As more leases are added, the software must be capable of scaling up to meet these increased demands. Systems that are not scalable can become a bottleneck for growth, forcing companies to invest in new solutions as they expand. Scalability means handling a larger volume of leases and also includes the ability to adapt to diverse international lease accounting standards.

Use of technology

There are some incredible technologies out there. From OCR (Optical Character Recognition) to NLP (Natural Language Processing) to the ubiquitous generative AI. Too many lease accounting solutions are not built around these technologies, putting them firmly in the “legacy solution” category. If your lease accounting software doesn’t let you upload contracts any way you want – including as a PDF – and then extract key data and even suggest journal entries and disclosure, it means you’re not getting the level of technology you deserve.

Time for reevaluation

Lease accounting software plays such a critical strategic role in both compliance and financial decision-making.

For compliance, it ensures adherence to complex and evolving accounting standards, including all the complexities around correct disclosure.

From a financial perspective, such software is integral in providing clear insights into the company’s lease liabilities and assets, which are essential for informed decision-making. It offers a comprehensive view of lease-related expenses and commitments, enabling better budgeting, forecasting, and strategic planning.

There are other benefits which are less obvious, but potentially even more valuable. For example, the ability to analyze lease terms and conditions can lead to more favorable negotiations and renewals, optimizing the company’s lease portfolio.

Why urgent reevaluation is required

Given the strategic importance of lease accounting software, it’s clear why reevaluation of current solutions needs to take place.

Moreover, the cost of sticking with a bad solution is high when you factor in:

- Increased manual work: More time and effort spent on data entry and corrections

- Higher risk of errors: Leading to frequent corrections and potential financial discrepancies – and even restatements

- Compliance challenges: Difficulty in meeting evolving lease accounting standards, risking penalties

- Employee dissatisfaction: Frustration with inefficient tools; impacting morale, productivity, and the motivation of new hires

- Resource drain: Diverting team and other resources from strategic tasks to manage software inefficiencies

Why Trullion

When reevaluating your enterprise lease accounting solution, look no further than Trullion. Trullion was created to solve modern lease accounting challenges, and is built around the latest technologies to offer enterprises the best of what lease accounting software can offer.

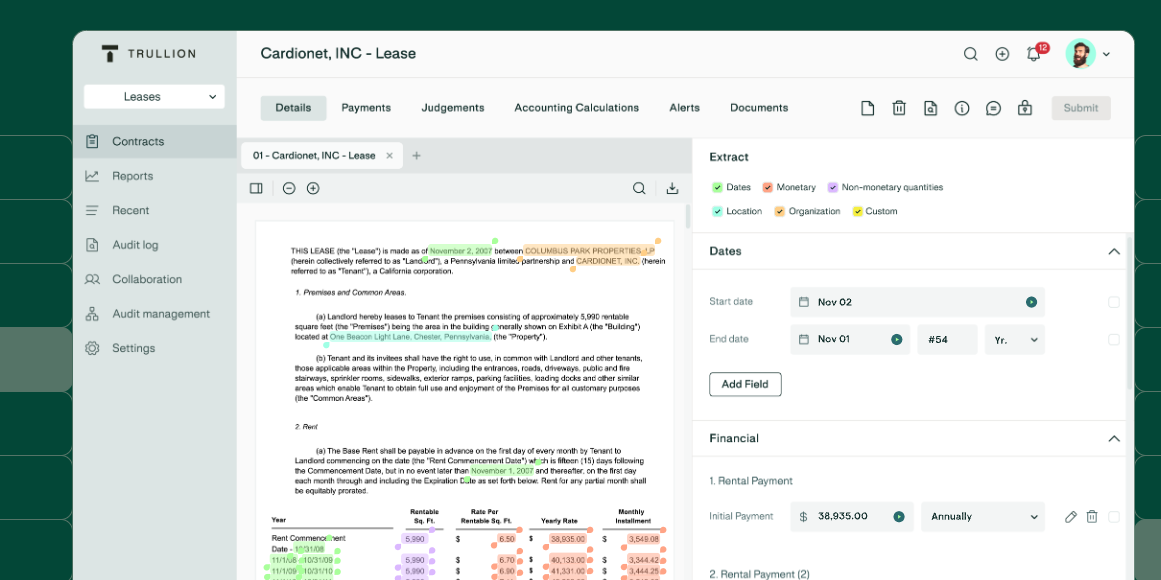

With Trullion’s lease accounting solution, you can automate contract data, easily handle lease modifications, take care of reporting, and a whole lot more – all powered by AI. Accuracy and compliance are assured, no matter the changes and updates to lease accounting standards.

Specifically, you’re now able to:

- Automatically manage and update contracts: just upload your PDF or Excel lease contracts with a single click

- Extract data automatically: highly accurate OCR technology extracts key data from source documents including names, dates, payment details and more

- Log detailed data automatically: complete audit logs verify and track changes for internal and external stakeholders

- Instantly calculate IBR: across any region, asset class or currency

- Seamlessly detect modifications: in real-time and at scale

- Get audit-ready outputs: including 100% auditable journal entries and disclosure reports, with source data just a click away

If you want to see how lease accounting software for your enterprise requirements could be so much better, reach out to the Trullion team today.