How Many Leases Need To Be Read in 2020?

As we’ve outlined previously, at least 4 million and upwards of 10 million leases will need to be read & reviewed by accounting teams in 2020.

We are assuming, of course, that this is the first time they’ll be adopting the new ASC 842 accounting standard.

Why Is It So Hard To Read A Lease in 2020?

Well, it depends what you are looking for. It’s easy to find 3 data points: a start date, an end date and a payment amount. These were the requirements under ASC 840, the old accounting standard.

Under ASC 842 (and GASB 87 and IFRS16) you will need to collect those data points, along with options, escalations, CPI, incentives, allowances, improvements and other risk factors. These are real estate or equipment leases that lawyers or facilities experts may be familiar with, but not necessarily the accounting team.

It can take 30 minutes or up to 3 hours to properly review and extract a lease for accurate compliance.

Who Exactly Has To Read These Leases?

First, the accounting team. This could be a Staff Accountant, a Manager, a Director of Reporting, or a Controller/CAO.

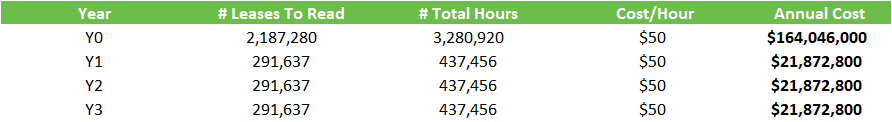

Then, an auditor will need to read them. Auditors won’t read all of the leases. What many audit firms do is define a process around ‘sampling’, whereby they review a subset of the leases – or the most material ones – to ensure the internal accounting teams accurately represented their reports.

So How Much Time Does It All Take?

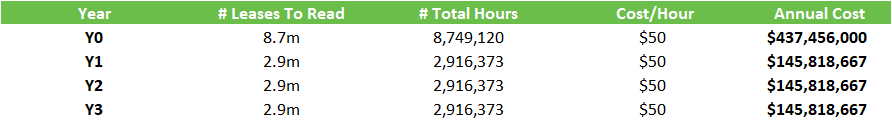

If we estimate 8.7 million leases need to be read, at approximately 1 hour per lease, this will take 8.7 million hours. Keep in mind this is in Year 1.

If we assume the average lease is 3 years (commercial real estate is 3-4 years, whereas equipment is 2-3 years), a sample time spent could be as follows:

In Conclusion

As you can see, the cost of reading leases and applying new ASC 842 standards will be significant, and could be in excess of $1bn in labor costs. Several firms have created managed services offerings around the new standard.

On the internal accounting side, the cost is significant, but it is distributed amongst 100,000+ companies. In your average small business, accountants will spend a few extra hours per year reading leases, and a few extra hours per month preparing journal entries & disclosures.

On the audit side, it is less distributed, and reading source documents is critical to a proper financial audit. So this cost will be distributed across a smaller number of firms, indicating more pressure on audit firm profitability. Tech-forward auditors will look at apply new technologies like AI to reduce the cost in this process while maintaining (or improving) accuracy.