ASC 842 and its effect on financial analysis

With ASC 842 still being a relatively new standard for most businesses, there is still much uncertainty around how the standard (or “Topic” in FASB parlance) will affect key financial data and ratios.

In this article, we’ll look at the effect that ASC 842 has on EBITDA specifically, and financial ratios in general.

We’ll take a high-level approach, but if you’d like a more detailed explanation for your particular business, reach out to a Trullion CPA expert.

What is EBITDA, and why is it important?

EBITDA stands for earnings before interest, taxes, depreciation and amortization. EBITDA is therefore calculated by adding interest, tax, depreciation, and amortization expenses back to the net income figure, thus increasing it.

It is a popular figure used when analyzing or comparing financial statements, and is used to measure an entity’s financial health and its ability to generate cash.

At this point it’s important to mention what EBITDA is, and more importantly, what it isn’t.

- While useful to many users of financial statements, EBITDA is not an official metric recognized under GAAP, and therefore this figure can be calculated differently in different scenarios

- There have been criticisms that it can be interpreted as overstating profitability – and it’s easy to see why many “drags” on profitability are removed, even though these were instituted by financial policy makers for good reason, and Warren Buffett famously said that “references to EBITDA make us shudder”

- It makes comparing companies, or even a single company over a period of time, a lot easier – more on this below

Why is EBITDA an important figure?

While many people consider accounting to be purely numbers focused, non-accountants are surprised to hear how much judgment and estimation goes into preparing financial statements. A small change to a crucial figure that is often based on, or contains, some measure of judgment – for example, the IBR figure in leases – can have a massive impact on a single line item, or even the difference between the reflection of a profit or a loss for the period under review.

The EBITDA figure aids in stripping out that judgment or estimation. Not completely of course, but it does allow for a more realistic view of the underlying profitability of a company without being affected by assumptions within depreciation calculations, tax strategies, or financing decisions.

EBITDA is used in many calculations, the most well known of which is probably the enterprise multiple (Enterprise Value/EBITDA) used in valuations.

How ASC 842 affects EBITDA

As many are aware, ASC 842 requires almost all leases to be included on the balance sheet through leased assets and liabilities, and the corresponding changes to these balance sheet items through the income statement.

The changes brought about by ASC 842 can impact the EBITDA figure, and will depend on whether a lease is classified as a finance or operating lease.

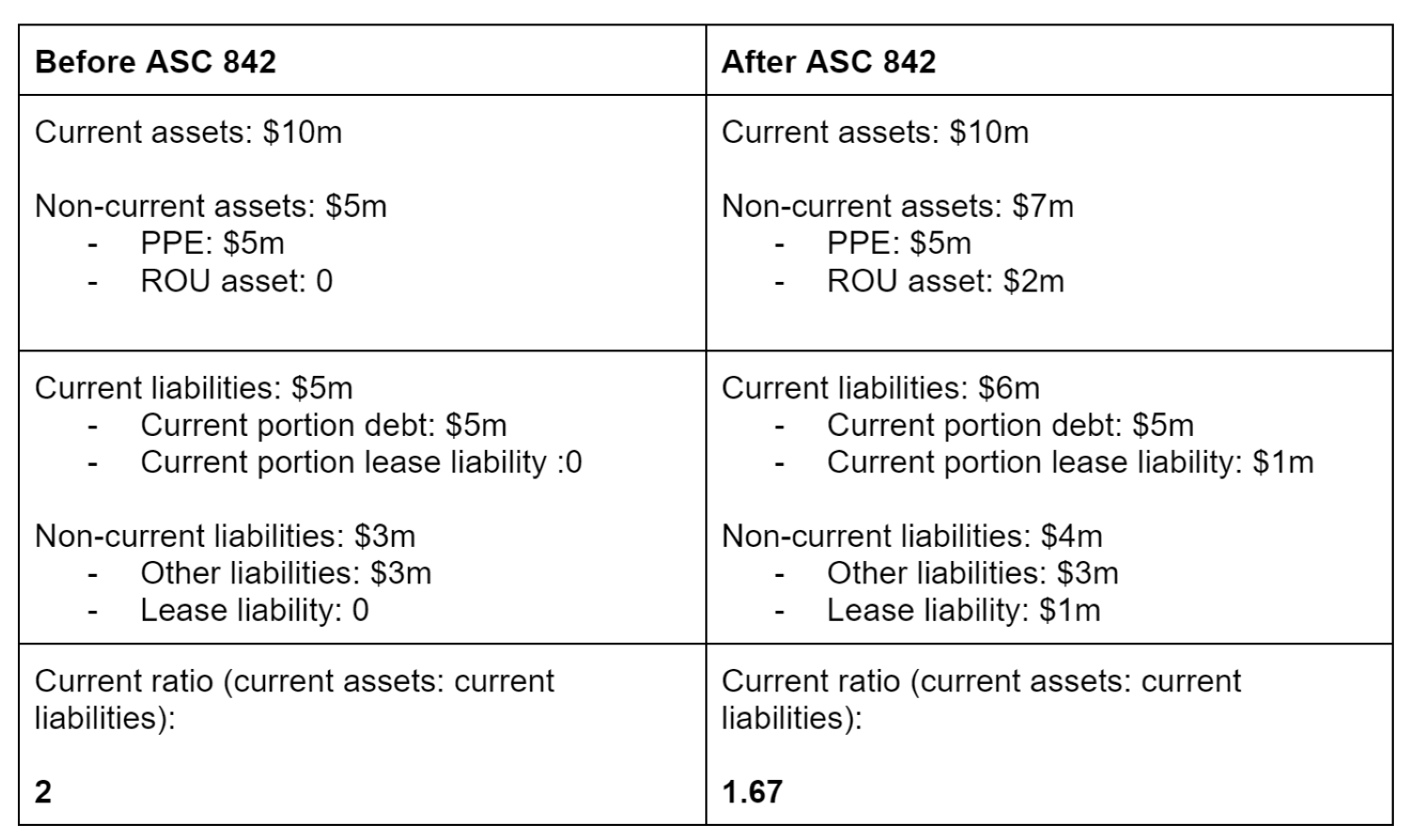

A key focus area is where, under ASC 842, the leased asset is classified as a long-term asset, while the corresponding lease liability is separated into a) short-term and b) long-term liabilities. This affects other key ratios that need to be re-examined, including the current ratio, debt service coverage, the debt to net worth ratio, and funded debt to EBITDA.

A short, overly-emphasized example that pertains to a single company, illustrates this point:

As can be seen from this example, many other ratios can be affected, including, figures that may have an immediate impact on debt covenants and the like.

ASC 842: ensure there are no surprises

While on the surface ASC 842 seems relatively straightforward, there are many areas of a company that can be affected in ways not initially expected.

The best way to stay ahead of the changes brought about by ASC 842 is to ensure that you’re able to see how much you’ll be impacted.

The best way to achieve this is through a dedicated lease accounting software solution, that can model the impact of different inputs, ensure constant compliance, and use automation to do the heavy lifting for you, so that you can be focused on the bigger picture.

To learn more about how you can benefit from an AI-powered automated lease accounting software solution, get in touch with Trullion today.