Financial auditing plays a critical role in the financial reporting ecosystem. Companies make their best efforts to compile their financial data in an acceptable format – such as GAAP, or IFRS – and present this data to financial stakeholders. Yet this process is prone to errors, lack of understanding regarding accounting rules, and even worse, fraud.

Enter the auditors. For decades, audit firms have been the key players in maintaining the level of trust that financial stakeholders seek.

As you can imagine, inspecting the millions of elements across a company to ensure 100% accuracy is nearly impossible for financial auditors, who have finite time and resources. Auditors thus use a process known as “sampling”. Sampling allows them to select a subset of the data and develop a confidence level around the broader population.

Let’s take an example: Company ABC is ready for their 2021 annual audit. Throughout the year, they received $2.5m in new revenue across 100 new customers. Company ABC recorded revenue based on delivering their product on time.

How does the auditor ensure that the $2.5m in revenue is accurate?

In a perfect world, they could verify that each of the 100 customer contracts are recorded accurately, that the invoices were issued appropriately, that their client’s obligations were met, the customers did not have any issues, no modifications were made, the price and product bundling was accurate, and so on.

Realistically, an auditor has many clients and limited time. So they could sample the population to verify the accuracy (whether substantive or control-based sampling):

Once they have sampled, say, 3% of the population, an auditor can declare that the information is likely accurate. This still leaves a financial audit vulnerable to errors and fraud.

As transactions and business models get increasingly complex, the pressure on the financial audit mounts. With the advent of new standards like ASC 606 (Revenue Recognition) and ASC 842 (Lease Accounting), this only increases the amount of data needed to complete a financial audit.

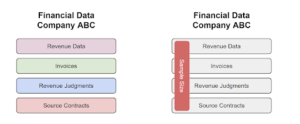

One of the latest innovations to help accelerate the audit process has been source-based accounting. Source-based accounting is when an accounting workflow is connected with the source data, such as a document. In source-based accounting, an auditor can track a financial entry on a company’s general ledger back to a source system or file.

Source-based accounting helps break down the classic siloes of an accounting process; such as files, emails, spreadsheets and journal entries all being in separate systems. This enables an auditor to swiftly navigate the audit trail, from financial entry to source data point. It also helps auditors move towards a more real-time and 100% audited environment.

Let’s take one quick example to see how source-based accounting would work in an ASC 842 lease accounting example.

Traditionally, auditors come in once a year to verify the leases of a company. This leaves a small window of time, and a lot of pressure, to ensure that this critical section of the company’s financial report is accurate. This puts pressure on the company’s financial team, pressure on the audit team, and can result in substandard results.

But with ASC 842 emphasizing significantly enhanced requirements for leases, this process can be improved by orders of magnitude. Imagine if auditors had access and visibility to client numbers, in real time, on an ongoing basis. Imagine if automated lease accounting software could continuously ensure that leases were being accounted for correctly, and all stakeholders could easily see the connection between final numbers being presented, and source documents.

This powerful image doesn’t have to be imagined – it is already possible today. At Trullion, we’re proud to be leading those efforts: offering an AI-driven automated lease accounting software solution that empowers companies to seamlessly meet compliance requirements, produce accurate and consolidated reports in minutes, significantly reduce costs, see immediate ROI, trace the audit trail back to the source data, access simple reports and clear financial schedules, generate fully compliant disclosures and share a live 360° data image of the transactional workflow with key stakeholders.

While the idea of source-based accounting may seem futuristic, it’s already happening across many areas in accounting, thanks to innovations in accounting software.

For more information, get in touch today.