As we step into 2023, the accounting world is on the brink of an exciting transformation. With advancements in technology, globalization, and changing business needs, the accounting industry is evolving to keep pace.

It’s time to gear up and embrace the future, and in this article we explore the most game-changing accounting trends that are set to shape the year ahead.

1. Artificial Intelligence (AI) and Machine Learning (ML)

More than just buzzwords, AI and ML technologies are rapidly changing the accounting and finance landscape. These technologies can help automate repetitive and manual processes such as data entry, freeing valuable time for accounting teams to focus on high-level, strategic activities. The ability to process and analyze large amounts of data in a matter of seconds has the potential to completely change the way accounting is done, making it more efficient, accurate and cost-effective. As a result, the adoption of AI and ML in the accounting industry is expected to surge this year.

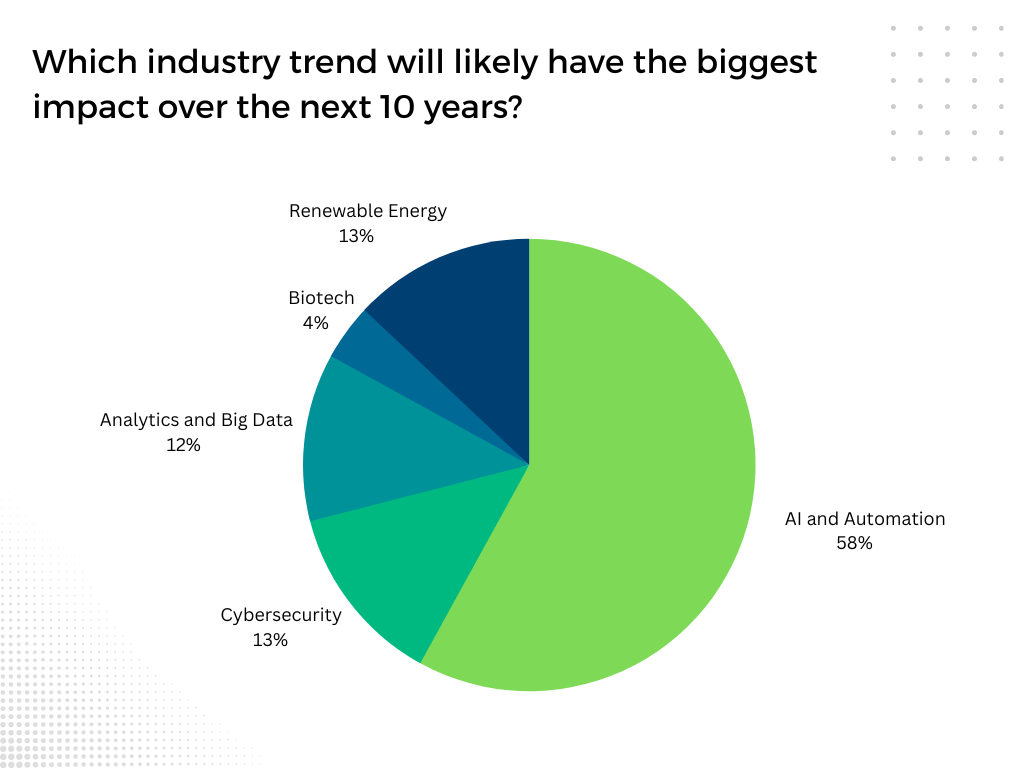

In a 2023 Trullion survey of 100+ finance professionals across a variety of industries, the majority chose AI and Automation to have the biggest impact over the next 10 years.

2. Cloud Computing

Cloud computing is becoming increasingly popular in accounting and finance, and for a good reason. Cloud-based solutions provide secure and real-time access to financial data from anywhere, making it easier for teams to collaborate and work together efficiently. Especially with hybrid and remote work here for the long run, accessing financial data from the cloud, whether at home or on the go, is paramount.

In addition, cloud solutions are often more cost-effective than traditional on-prem systems and are easier to scale as business needs change. The scalability of cloud computing enables accountants to work on projects together without the need for expensive hardware upgrades, and the investment in security technologies by cloud providers offers a higher level of protection for financial data. This results in increased efficiency, mobility, and cost savings for accountants and their clients.

3. Cryptocurrency

Cryptocurrency is becoming a more prevalent trend in accounting, as it continues to gain wider adoption and recognition as a legitimate form of currency. Accounting for cryptocurrencies involves tracking and reporting transactions, calculating gains and losses, and determining the tax implications of these transactions. The increasing use of cryptocurrencies for payments, investments, and other financial transactions is leading to a growing demand for accountants with expertise in this area. While cryptocurrency is still a relatively new and rapidly evolving field, it is likely to become an increasingly important area of focus for accountants in the coming years.

4. ESG (Environmental, Social, and Governance) Reporting

As the importance of sustainability and social responsibility continues to grow, companies are expected to provide more comprehensive ESG reporting. This trend is driven by a growing number of stakeholders, including investors, employees, and customers, who want to know how companies address environmental, social, and governance issues.

ESG considerations are becoming a major factor in the investment decision-making process. Investors are placing more emphasis on ESG performance when making investment decisions, and companies are under increasing pressure to demonstrate their commitment to sustainability and corporate responsibility. As a result, ESG reporting is becoming more prevalent and there are a growing number of regulations and standards being developed to help companies disclose their ESG performance. This means that accountants will need to have a good understanding of these regulations in order to assist companies in meeting their reporting obligations and accurately presenting their ESG performance to stakeholders.

5. Cybersecurity

With the increasing use of technology in accounting and finance, there is a heightened focus on cybersecurity to protect sensitive financial information. Organizations must implement measures to protect sensitive financial information stored in their accounting systems, maintain the integrity of that data, and comply with regulatory requirements. This includes measures such as encryption and multi-factor authentication to prevent unauthorized access to financial data, and regular security audits to ensure that data remains accurate and up-to-date. Cybersecurity is critical in accounting because it helps to ensure that financial reports are accurate, protect against financial fraud, and comply with regulatory requirements.

As technology continues to evolve, it is essential for accounting professionals to stay up-to-date on the latest developments and adapt their skills accordingly. Whether you’re a seasoned professional or just starting your career, staying ahead of the curve will help you be more successful in your role and better equipped to meet the changing needs of your organization.